As India currently has a strong pipeline of B2B tech marketplaces in the private markets, we are inevitably going to see them all likely receive handsome receptions on the bourses in the near future, owing to their capital efficient, asset light and highly scalable model

Today, every consumer desire is fulfilled at the click of a button: cars, personal care, home décor, food delivery, and the list goes on. In the past decade, we have witnessed rapid e-commerce growth, which now constitutes 5% of total retail, amounting to ~$40BN. India’s progress on the B2C e-retail side of the world is astounding, however it’s spoken about far too much.

While the process of ordering from the restaurant of your choice is awfully simple, the restaurant’s procurement of supplies is a manual, time consuming and repetitive process. Ditto for D2C personal care brands, furniture companies and so on. Long story short, B2B remains relatively far less digitized and organized despite its large market opportunity, high capital efficiency and low/zero CAC. The eB2B market size in India is $1.7BN, constituting a mere 0.3% of the total retail market. However, given strong macro tailwinds and the consequent acceleration of tech-first B2B marketplaces, this market is expected to reach $60BN by FY25.

.png)

Source: Redseer Research

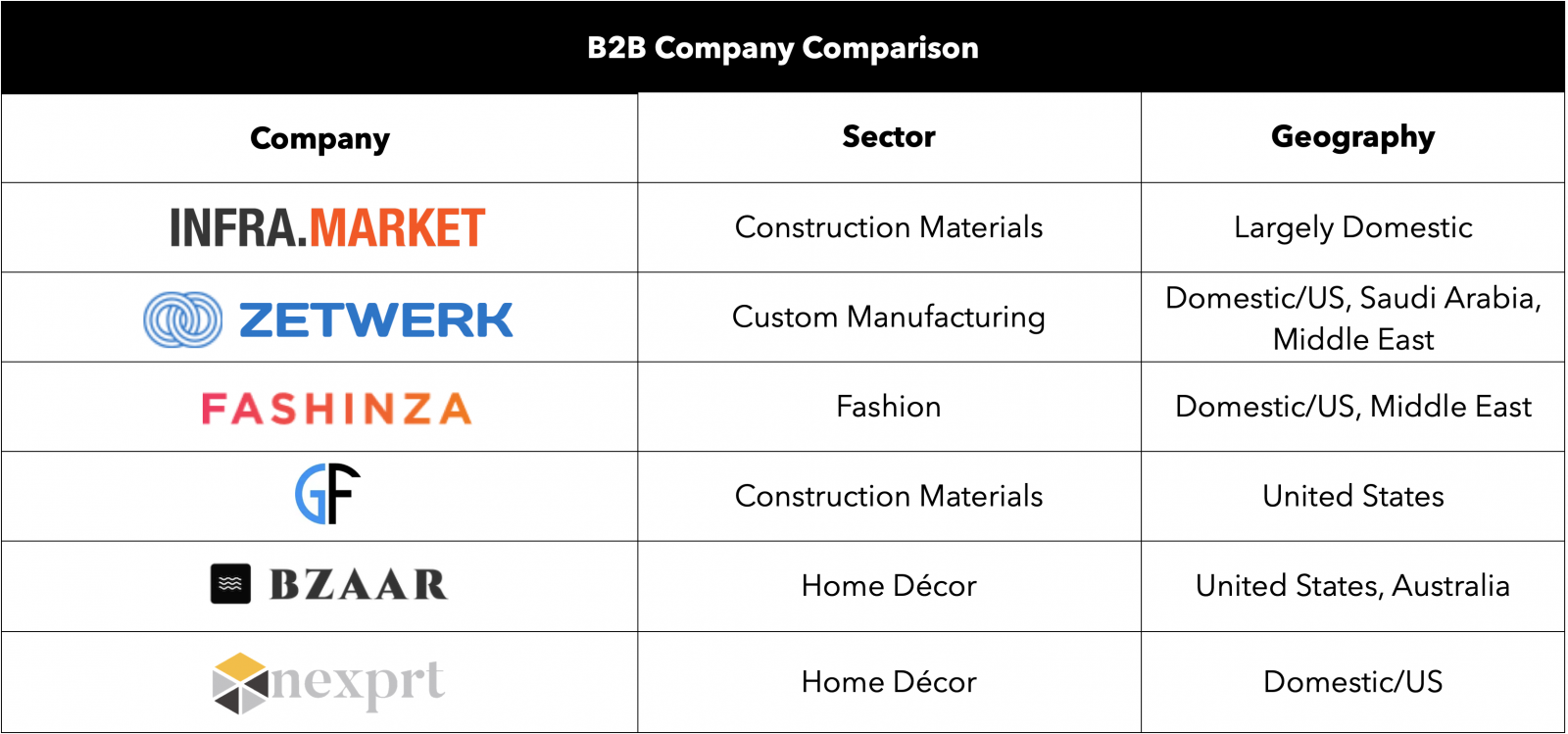

Despite B2B penetration lagging B2C penetration globally, India has witnessed a surge in B2B marketplaces across categories ranging from seafood to fashion to industrial goods

To say B2B marketplaces have been in the spotlight since 2020 is an understatement. For context, OfBusiness, a raw material procurement and credit for SME marketplace, has experienced a 6X increase in valuation in 8 months, going from being valued at $800MM in April-21 to a staggering $5BN valuation in December-21. Similarly, Infra.market achieved the coveted unicorn status in February-21, after which its valuation grew 2.5X within six months. Infra.market is also rumored to be raising another round of funding, which will value the construction materials marketplace at over $4BN. In the soonicorn world, Ninjacart, Bizongo and Captain Fresh have been making the headlines with $145MM, $110MM and $40MM funding rounds, respectively. WayCool Foods, having raised $111MM in equity so far is also on this list.

Now, we’ve established a couple of things: there is a necessity for tech-first B2B marketplaces, and this sector is currently going through a funding frenzy. However, not all marketplaces are the same. Just as you have your personal preferences of Verstappen over Hamilton or Messi over Ronaldo, we, at Lightbox, prefer managed marketplaces over other marketplace models.

Here’s a short explanation on the existing models:

Open Marketplaces – the buyer has complete flexibility in choosing its supplier for a particular product or service. Essentially, the marketplace has no control over supply. This model is typically suitable for non-commodity products.

Managed Marketplaces – these marketplaces aim at owning and organizing the supply and demand side of the market. Through the journey, real-time updates are consolidated for customers, who have complete access to their order right from design to delivery. In this model, the marketplace has an independent rapport with both supplier and buyer. Typically, this model works best for large quantity and slightly more commoditized orders.

Others – Listings, Closed Marketplaces, SaaS – Enabled etc.

In the managed marketplace model (the one Lightbox likes), the company has control over supply, resulting in greater tangibility in the entire buying-manufacturing-delivery process. When the marketplace cherry-picks its supplier based on the nature of an order, timeliness and quality are guaranteed, as the company knows the capabilities of every manufacturer like the back of their hand. Consequently, the customer acquires greater trust for the marketplace through the timely delivery of their products, while the supplier is incentivized to meet their deadlines as their capabilities and production bandwidth are carefully considered and monitored.

Additionally, there are demand focused and supply focused marketplaces. For the time being, most B2B marketplaces are aggregating demand first and consequently consolidating supply. For example, Infra.market targets project contractors instead of targeting materials manufacturers. Similarly, GlobalFair is targeting project developers in the United States as opposed to going after tiles manufacturers in Morbi, Gujarat. In other words, supply is demand-induced, instead of demand being supply-led. However, once the category matures, every marketplace will be a convergence of a demand/supply B2B marketplace.

There is another small technicality before we dig right in: push and pull categories. A push category refers to any category influencing demand, whereas a pull category is created due to pre-existing customer demand. Apparel, construction materials and home décor are all push categories, as companies market their product to trigger demand from their target group. On the contrary, pharma and FMCG are pull categories as their target group influences supply. In the push category, there is immense scope for the establishment of one’s own brand, driving higher margins. Infra.market is personifying this with their private label cement and ceiling fans. However, in pull categories margins are very tight and there is little scope for the penetration of a private label in largely indifferentiable product offerings. There are no prizes for guessing that we at Lightbox are big on brand creation and product innovation, which makes us bullish on the various push categories.

Disclaimer: For the sake of simplicity, every time we mention B2B marketplaces henceforth, we are referring to B2B managed marketplaces.

Coming to the question at hand, why the sudden buzz? There lies a tremendous opportunity to organize and disintermediate the traditional manufacturing supply chain across various categories.

In a traditional supply chain, goods flow from manufacturers to distributors to smaller distributors to retailers and then to the end consumer.

Think about the metro project/coastal road construction near your house. J Kumar and L&T have been contracted to fulfil these projects. You probably wonder why each of these projects takes a painfully long time to materialize. One of the primary reasons is that the procurement of the various materials required for on-site construction comes from different manufacturers, often running on their own timelines. Juggling timelines and managing orders from numerous suppliers across a network with far too many intermediaries is a perfect recipe for delayed deliverables (a completed metro line (hopefully)). Throw in the fact that these suppliers use limited technology, and you’re rubbing salt into the wounds.

This results in the customer experiencing repeated time lags through a largely opaque supply chain, which leads to low quality products and little customer trust. As a result, the manufacturer receives unpredictable demand, utilizes limited technology, experiences low customer conversion and often makes little investment into overheads.

Due to the pandemic, manufacturer problems were exacerbated: their access to capital became restricted and their balance sheets were compromised. Tech-first B2B marketplaces that were well capitalized were ready to take advantage of this opportunity, offering quality products at reasonable prices, while respecting timelines. As we like to say, “Jugaad is out, quality is in.”

This is what they look like and where they step in:

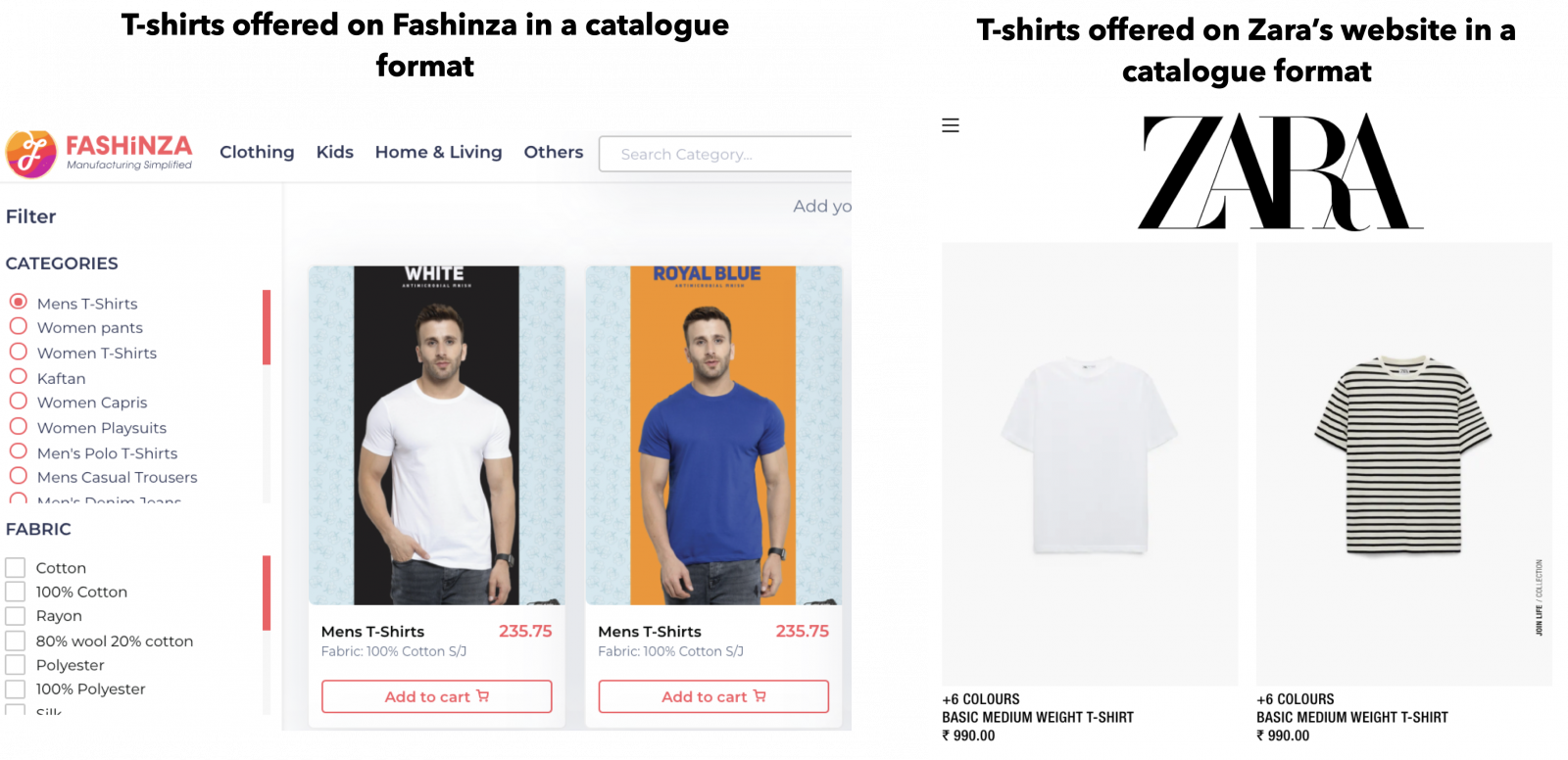

These businesses are asset light in nature, as they don’t own any manufacturing plants or hold much inventory. Companies like Fashinza, Zetwerk etc onboard a host of suppliers, enhance their tech capabilities and provide their suppliers with consistent demand, ultimately utilizing their production capacity to the fullest. For customers, these managed marketplaces take ownership of the service, making them a trusted partner for their customers’ procurement needs. Owing to the marketplace’s tech adoption, they provide a digital storefront, similar to a B2C shopping experience.

Now, coming back to the coastal road example (bear with me please:). Zetwerk has been sub-contracted by L&T to fulfil orders for marine cap shutters, (shown below) ramp shutters, trestle bracings etc. required for the foundation of the project’s bridgework. With Zetwerk’s one-stop-shop offering, L&T is no longer required to place orders from various suppliers at different locations, ensure timely logistics, manage payables, request samples etc.

Zetwerk, with its tech-first offering, disintermediates the otherwise crowded supply chain to ensure timely delivery of quality products. This results in less coordination and more cost saving for L&T, quick traction and a large monetizable opportunity for Zetwerk and consistent demand for SME manufacturers. Win-win for everyone!

.png)

The key moat for these B2B marketplaces: ability to corner and lock in supply, enable consistent demand for SME manufacturers and secure quality of product for the marketplace’s customers. Additionally, these companies operate in segments where there is no competition in terms of a large incumbent.

Source: Company Website

The fragmentation of the Indian manufacturing industry is immense. At the same time, the idle talent and unutilized opportunities are also tremendous. From our findings and conversations with industry veterans and founders, there is infinite potential and talent waiting to be unlocked in India. As clusters of different manufacturing talent are spread across the country, they require technology, consistent demand and investments into overheads to maximize their potential. For example, Morbi is India’s manufacturing hub for ceramic tiles, while Udaipur has the highest concentration of extractable granite in the world. It is needless to mention that the stage is ripe for disruption.

Lightbox is strongly invested in the idea of organizing the unorganized and disintermediating the fragmented. This is apparent with our investment in WayCool. WayCool is reimagining India’s food supply chain by connecting farmers to customers through automation and technology along the supply chain. As a result, better quality produce is delivered to the customer, simultaneously driving value for farmers by integrating at source.

Improving a supply chain that would otherwise result in 35% wastage accentuates our thesis of investing in companies that are making a change in India, especially from an ESG standpoint.

Having wet our feet on the B2B side of the world through WayCool and Paymate, we have understood the scalability of these businesses and the magnitude with which they contribute to the socioeconomic development of India. The tech enabled B2B marketplace model epitomizes the provision of opportunity by bringing national and global recognition to the SME manufacturer.

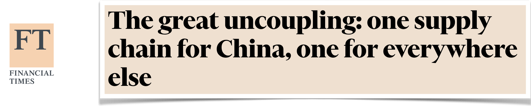

In India, economic growth slowed down in 2019-20 which pushed manufactureres to evaluate innovative utilization of their capacities. As mentioned previously, the traditional supply chain experienced a major jolt during the COVID pandemic, diminishing manufacturer’s access to capital and further exposing their balance sheets. Additionally, with the ongoing search for a China + 1 manufacturing destination, India’s raw material advantage and low cost of labor provides the perfect macro climate for the emergence of tech enabled B2B marketplaces.

What’s encouraging for these companies is that India’s exports are projected to reach $400BN for FY22, having consistently registered a record $30BN+ worth of exports for every month in FY22. Traditionally, China has always outpaced and outdone the rest of the world when it has come to large-scale repetitive manufacturing. India has been better known for its medium-batch value-add manufacturing capabilities. The time couldn’t be more opportune for India to hone in on what it does best and leverage the supply-side push that the B2B tech-marketplaces are accelerating.

What’s even more encouraging is that the categories these marketplaces play into have large addressable markets, with additional headroom for growth. In essence, the playbook has been scripted – only execution awaits!

.png)

Source: Times of India, Allied Market Research, The Economist

But what exactly is custom manufacturing and why the hype around companies like Infra.market?

Custom manufacturing refers to precision manufacturing for a unique order, custom made to meet the requirements of the client’s needs. Zetwerk specializes in the aerospace, automotive, oil and gas sectors with clients ranging from Tata Steel in India to the Bossard Group in Switzerland. Fun fact: more than 100 Western companies have moved their supply chains to India via Zetwerk, across industrial and consumer products.

GlobalFair is aggregating SME manufacturers in the Gujarat-Rajasthan belt who specialize in natural and engineered stone countertops and hard surfaces. Their primary focus is on the US-India corridor, as the company believes they will leverage their supply-side expertise to capture a fair share of India’s current $5BN of exports to the broader $240BN US construction materials market. As GlobalFair increases their client retention and wallet share, they will launch their private label across various kinds of flooring and countertops.

Infra.market, in a span of four years, is becoming a household name. It started with aggregating demand and supply for concrete and has now built a private label brand in categories across concrete, aggregates, walling solutions, construction chemicals, bath fittings, sanitary, tiles and electrical (LED lights and fans). Infra.market currently has 25 exclusive franchisee stores, with over 620 dealer owned and operated stores. On the back of this, the company grown 80x in the past four years.

.png)

In the fashion space, Fashinza believes that the incumbent supply chain for e-com brands is rigid. Therefore, they have created a transparent supply chain built for e-com, which focuses on on-demand and flexible manufacturing, low inventory and wastage, ethical sourcing and the provision of credit for both brands and suppliers. With this business model, Fashinza has scaled 10x in 12 months with an increasing global footprint. Some of their clients include: Forever 21, Clovia, Myntra, Ajio etc.

Similarly, Bzaar, Nexprt and Geniemode are examples of companies building a similar playbook in the home décor category. All three companies have concluded rounds of financing in 2021, proving that founders building B2B marketplaces are very much in the VC spotlight.

Conclusion

To say manufacturing incumbents will be displaced as a result of tech-first B2B marketplaces is a long shot. However, one thing for certain is that the incumbents will have to invest strongly in technology, to be as agile as the upstarts. There is no time for complacency for the incumbents, as consolidation and tech integration of SME manufacturers by B2B startups has ensured that these companies have already started eating the incumbents’ lunch.

In the US, we have seen this play out with Xometry. Caesarstone, a global leader in manufacturing quartz surfaces, trades 6x lower than Xometry, a custom manufacturing marketplace that listed early in 2021 Evidently, investors understand the necessity of technology coupled with the asset-light model that companies like Xometry adopt.

.png)

As India currently has a strong pipeline of B2B tech marketplaces in the private markets, we are inevitably going to see them all likely receive handsome receptions on the bourses in the near future, owing to their capital efficient, asset light and highly scalable model

Signing off with some key takeaways:

So, finally, are you Being to Be (B2B) or Being to C (B2Cing?)