Our latest report -- Solving for India’s Elders: A Latent but Inevitable Market Opportunity – offers insights into the current state of the eldercare market in India, the limitations of existing services and products, and emerging white spaces that offer prospects for building services and brands tailored for the elderly. Watch the video or read the extended PDF version.

India's elderly are the fastest growing segment of the country's population. The elderly currently constitute around 11% of India’s 1.4 billion-plus population. By 2050, it’s estimated that more than 20% of the country’s population will be over the age of 60, driven by declining fertility and increasing life expectancy. Against the backdrop of growing consumption across the board, eldercare in India presents an untapped opportunity.

In our latest report -- ‘Solving for India’s Elders: A Latent but Inevitable Market Opportunity’ – we offer insights into the current state of the eldercare market in India, the limitations of existing services and products, and emerging white spaces that offer prospects for building services and brands tailored for the elderly.

While the elderly are by no means a monolith, they do skew heavily towards spending on healthcare and away from discretionary spending (so far), which provides the initial lens through which we examine opportunities in this space.

There are significant health challenges unique to the elderly population that are inadequately addressed today. While there is a need for services (and to a lesser extent, products) to improve and expand the healthcare experience, the market for them is relatively fledgling and existing/emerging models have not yet proven scale and sustainable economics.

In our analysis of the eldercare market opportunity, we looked at the limitations and complexities of existing segments such as home care and assisted living, and explored white spaces where elders and their children may be willing to spend. Beyond health, we are also at the starting line for an uptick in discretionary consumption by young and soon-to-be (urban and mid-high-income) elders, who earn and consume more than previous generations, have an entirely different relationship with tech, and are increasingly open to planning for their elder years.

Overall, there is high conviction on latent demand and the inevitability of this market. This thesis is a foundation upon which to build further views as the landscape evolves.

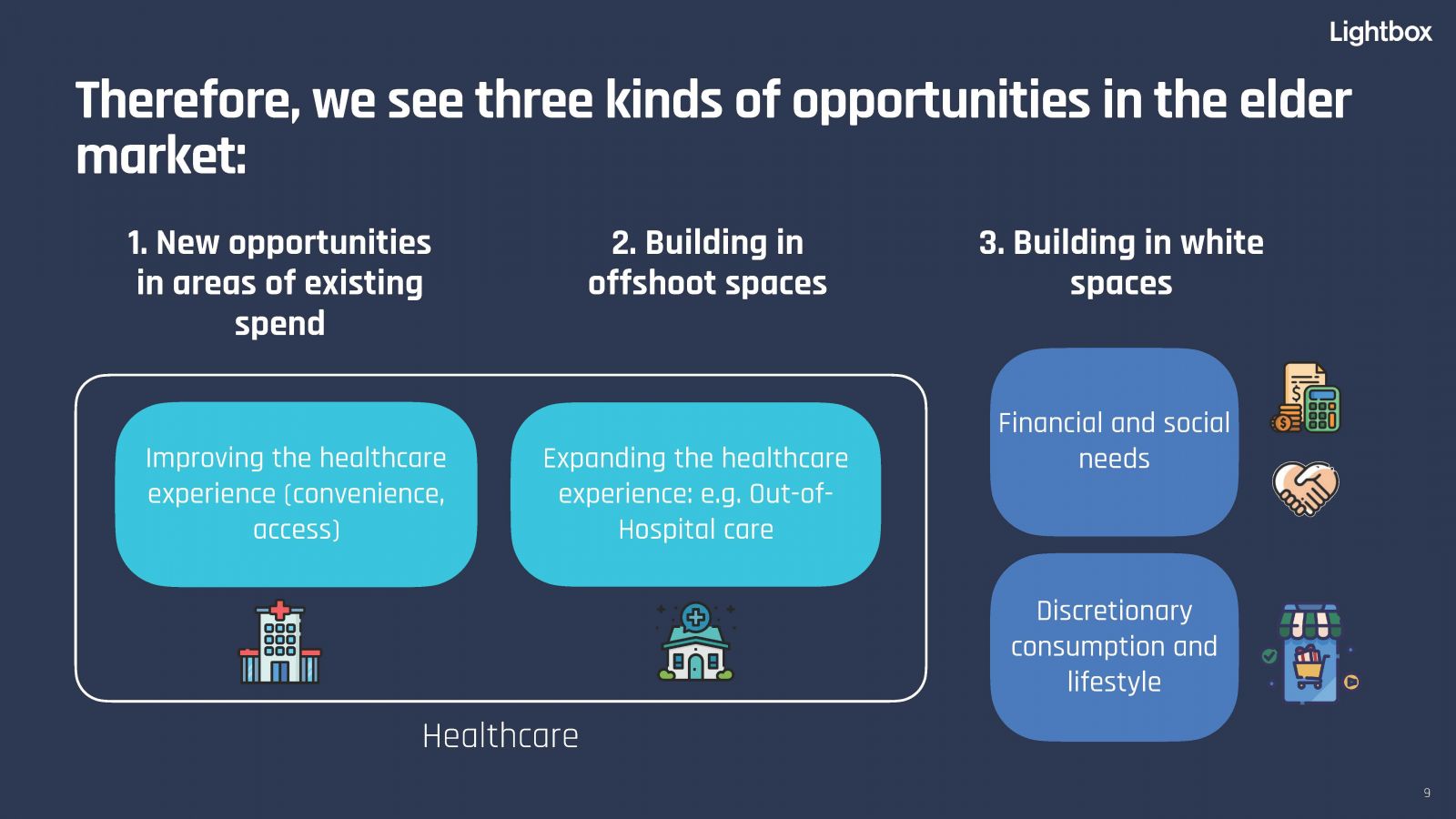

1. Three buckets of opportunities. One, improving the traditional healthcare experience. Two, offshoot spaces such as ancillary healthcare, newer services that expand the healthcare experience. Home care is one example. Three, discretionary spends, which could be anything from financial products to social spending, whether it's brands, products, services.

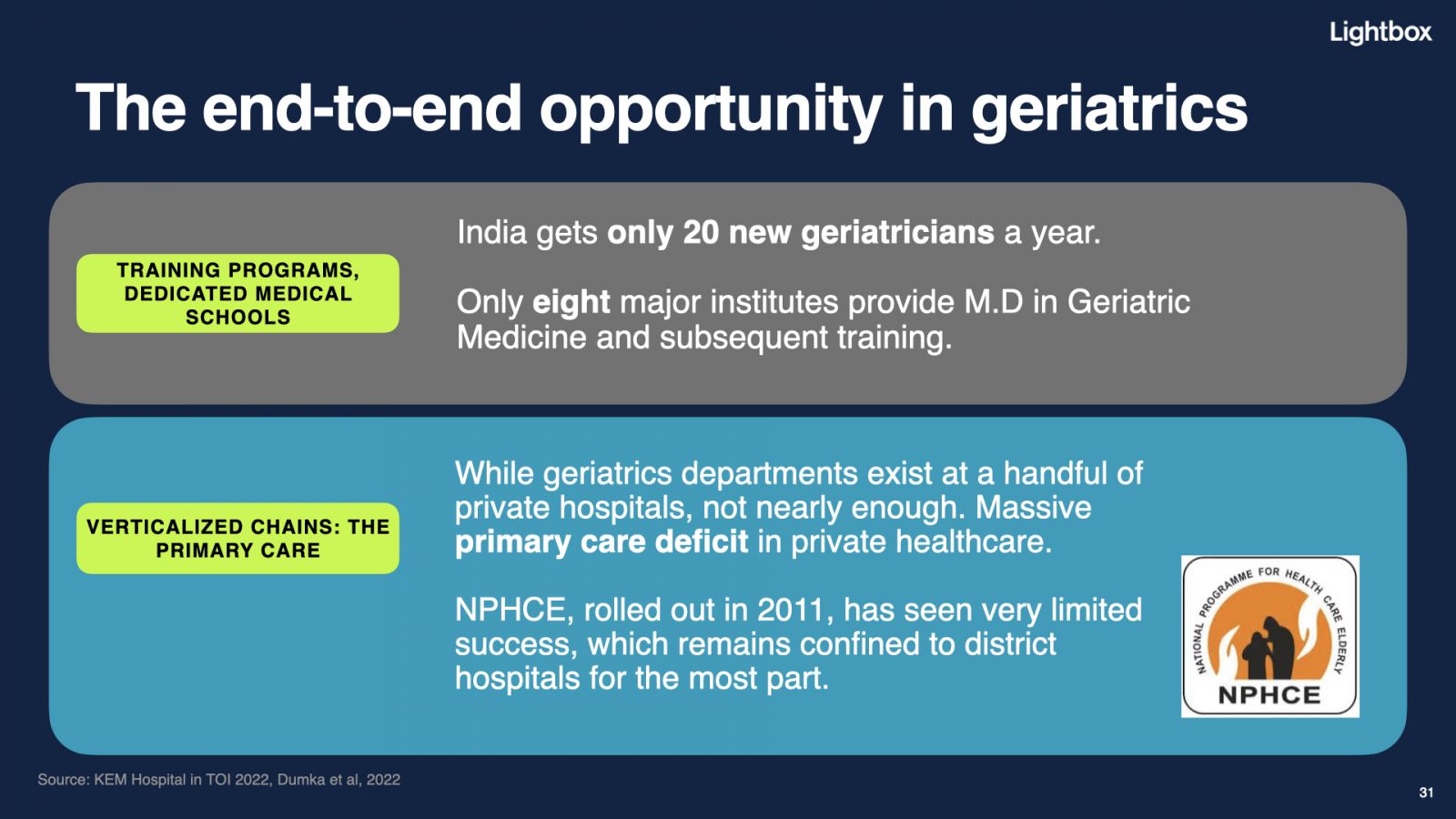

2. Geriatrics as a discipline is an incredibly exciting opportunity. A dedicated geriatrician can look at health concerns and the interplay between them in the context of the elder as a whole. They can coordinate further treatment as required, and make the process easier and more accessible for elders overall. There’s an end-to-end opportunity here. One, on the training/education side (India gets only 20 new geriatricians a year, and only 8 major institutes provide an MD in Geriatric Medicine). Two, as a verticalised chain-of-clinics opportunity.

3. The goldilocks segment for building consumer brands in eldercare is ‘young old’. We borrow the term from the WHO and modify it to refer broadly to those under 65 at present, and even to the soon-to-be old – those 50 and older.

Watch the video for a deep-dive into what the eldercare market in India offers entrepreneurs, investors and consumers.

To access an extended PDF version of the report, click here Solving for India's Elders -- Lightbox Report.