‘Pay Later’ is a product that will always be needed as it allows for instant gratification purchases and reduces guilt by not having to pay for everything today. The faster, frictionless and credit payment method gives the consumer a sense of trust in the platform to transact.

The notion of finding friction in a product or service and providing a better consumer experience often unlocks massive value for the ecosystem. Over the past decade, we have seen numerous startups reduce friction in the lives of consumer – Flipkart did that with making it easier, convenient and faster to shop online, Ola made finding a taxi easier and the list goes on..

Similarly, in the payments industry over the years we have seen massive disruptions from cash to merchant credit to cards to digital wallets to UPI (only in India) that have reduced friction for both consumers and merchants to make and receive payments. Buy Now Pay Later (BNPL), is the newest payment method on its way to becoming ubiquitous by removing friction in e-commerce transactions.

Fun Fact – The payment platforms and those that enable payments are valued higher than some of the biggest banks today

What is Buy Now Pay Later?

As the name suggests ‘Pay Later’ products by definition is something that allows a consumer to acquire a product or service today and pay for it later. This option is available at the checkout process via multiple products like credit cards, traditional interest based instalment loans (EMI) and the new age BNPL apps. Similar to credit cards and instalment loans, BNPL is a form of credit payment that allows a consumer to instantly acquire the product or service via interest free or low interest instalments over a specific period of time. The difference between BNPL and other ‘pay later’ methods is the design of the product that is benefiting both the consumers and the brands/merchants. More on these benefits below.

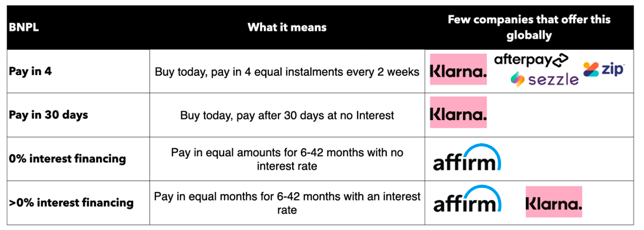

How the BNPL products look at the checkout page globally

The most popular product in BNPL offered by players like Klarna, Afterpay, and Sezzle is Pay in 4. It allows the consumer to buy the product today at 25% of the price and pay the rest of the 75% in 3 instalments every 2 weeks at 0% interest and no additional fees. Other similar product is Pay in 30 days which gives the consumer 30 days to make a payment. Affirm, another BNPL player, provides 0% interest financing that gives the consumer a period of 6 - 42 months (longer term) to pay for the product without paying interest on it.

Note: Affirm also offers interest based instalment products (like EMI) to consumers to pay in 6-42 months at much lower interest rates than the credit cards. But for this blog, our focus is primarily on 0% interest BNPL products. 43% of Affirms GMV is from 0% interest loans and 57% is from interest based loans (like EMI). But for this blog, our focus is primarily on 0% interest BNPL products.

The rise of BNPL as an online payment method is growing rapidly

Globally about $22 TN is spent on retail every year and with the rapid penetration of e-commerce, there has been a surge in BNPL payments as well. The widely used payment methods in e-commerce transactions currently are Digital Wallets, Credit Cards and Debit Cards. In the next 4 years, the market share of credit cards is expected to decline and the market share penetration of BNPL is expected to double to 4% by 2024E.

In fact, in countries like Australia, Sweden and some parts of Europe the market share of BNPL for e-commerce transactions is already above 10%. Additionally, in the US, BNPL saw a surge of 475% in GMV in just 18 months. The leading BNPL players combined have over 100MM+ active consumers globally onboarded that are transacting on the BNPL platform with 400,000+ active merchants.

Consumers use BNPL for two reasons - Credit and Convenience

For credit

· Instead of having to apply for a traditional loan to purchase a $200 shoe, consumers prefer to use BNPL. Afterpay, a leading BNPL player in Australia, aptly defines itself as “Help consumers budget for life’s little extras without needing to enter into a traditional loan or credit product for their retail purchases.”

· Consumers that don’t have access to credit cards and typically use debit cards or digital wallets to make payments access credit via BNPL

For convenience

· BNPL as a budgeting tool – 75% of Afterpay’s customers claim that they use BNPL as a useful budgeting tool for making purchases to better manage their finances

· Currently, BNPL is one of the most frictionless payment methods available online. With a few clicks consumers can make a payment as opposed to credit/debit cards

· The convenience of buying a product now while paying little upfront meets the consumers demand of instant gratification and reduces their guilt by allowing them to pay later

In the early days, BNPL adopters were driven by the desire to avoid credit card debt, the current wave of new users are attracted above all by the convenience and flexibility of BNPL financing, according to Marqeta.

Who are the typical consumers and what do they buy using BNPL?

A majority of the BNPL consumers are individuals typically aged between 25-44 that want to buy products that may seem a little out of their budget. Despite being in credit rich countries (US, Australia) consumers are opting for BNPL as they typically want to avoid paying sky high credit card interest and load themselves in credit card debt.

The users are typically Millennials and Gen-Z, aspirational in nature and want to stay relevant with trends. Consumer Electronics, Clothing/Fashion, Personal care and Home appliances via e-commerce are the leading categories where consumers opt to use BNPL as a payment method. Just like credit cards, BNPL is majorly used for aspirational products rather than essential products.

Not only do consumers like using BNPL, but brands and merchants benefit from the product as well

Digitally, many merchants want to provide their customers with the best experience but merchants face a number of issues which lead to consumers dropping off without making a purchase. One of the leading problems for e-commerce brands is cart abandonment– according to research, in 2018 shoppers left more than $34BN (7% of digital commerce that year) in their online carts. BNPL as a payment method is helping merchants convert consumers

The leading BNPL players have seen merchants improve key metrics-

· Klarna – 58% increase in AOV, 30% lift in checkout conversion rates

· Affirm – 87% increase in AOV, 20% increase in conversion rates

· Afterpay – Improved purchasing frequency, loss rates and customer lifetime value

Merchants have openly talked about the benefits of BNPL at the checkout process during their earnings call

Goes to show that BNPL isn’t just another payment method. It’s helping merchants discover new customers, increase conversion in sales, reduce drop offs and increase AOV.

BNPL is a far more consumer friendly pay later product than a Credit Card

The business models that credit cards are built on rely on customer failure. Having 60% revolving credit users (Outstanding balance is carried over to the next month where interest starts being charged) makes the credit card business model very profitable.

The main difference between credit cards and BNPL is that - BNPL offers no or low interest to users as it has a fixed repayment cycle whereas credit cards offer revolving credit which has a flexible repayment cycle and an interest rate of 3-4% a month.

For instance, let’s take the US which has the highest penetration of credit cards and accounts for 70% of all credit cards circulated globally. In 2018, credit card drove $1TN in lending. On this the consumer paid $121BN in credit card interest and $3BN in late fees -Yikes!. Despite, all the credit card reward points that are attractive to consumers, the product isn’t good for most of the consumers. Large banks make 10x the amount of money from consumers than they do from merchants and it’s no wonder then that credit cards are sold so aggressively to consumers.

BNPL Revenue Model is driven by brands/merchants and not consumers

Unlike credit card businesses where over 80% of the revenue comes from the consumers, BNPL players like Klarna and Afterpay make less than 20% of their revenues from consumers in the form of late fees. Their only consumer revenue comes from late fee charges of $7-8. If consumers miss the payment, this fee is usually capped at 25 -30% of the outstanding value of the loan. The bulk of revenue come from merchants and brands that BNPL players partner with. The fee paid by brands and merchants which is at an average of 4%+ (range varies from 3-6%) as compared to a maximum of 3% for what credit card companies charge. Often, merchants are willing to pay the extra 100-300 basis points to BNPL players since they help increase sales and order value which isn’t necessarily the case with credit cards for e-commerce transactions.

The best way to think of BNPL is that the extra basis points that the brand is spending is an expenditure from the marketing budgets as it’s leading to higher conversions, average order values and eventually revenues. The revenue model only works when the integration between the customer and merchant exists.

BNPL has become an alternative solution to credit cards – Your Margin is my opportunity!

The CEO’s of leading BNPL players also believe this

Over the past few years the dominance of credit cards is on a decline –

· US, that has 70% of the credit cards in circulation, has seen the lowest penetration of credit cards for under 35’s since 1980’s;

· UK has experienced negative credit card growth rates and in Australia the credit card outstanding amount decreased by 20% in the last year alone

· Debit and cash transactions are the leading form of payments worldwide.

Clearly, the BNPL product is better designed than the credit card products from the consumer and merchant point of view.

The scale of the leading BNPL players

Pay Later products in India

Pay Later products are fairly common in India. Instalment loans like EMI is the most popular pay later product followed by credit cards and the new age BNPL apps.

Credit cards in India lack transparency and have low penetration but make up a fairly large market

Credit cards are businesses that lack transparency and benefit the issuer, especially in India. For instance, 70% of CRED users (an app that rewards you for paying credit card bills) didn’t know the interest rate charged by their credit cards. Moreover, in India, a user gets a notification (SMS) when a transaction takes place but doesn’t get a notification when the credit card issuer charges the customer a fee.

Despite having a 3% penetration in India, credit cards are a fairly big market. About 35MM users have 57MM credit cards which accounts for $7BN in revenues and $1BN in net profits. Similar to the global markets, most of the credit card revenue come from consumers in the form of interest and fees. The one differentiating factor is that globally credit card users are majorly transactors and revolvers. Whereas, if we look at the 2nd largest credit card player in India – SBI Cards – roughly 30% are transactors, 35% are revolvers and 30% are using it in the form of EMI. Either the consumer converts the credit card outstanding balance to EMI’s or opts for EMI on credit cards when making a purchase since EMI offers a longer time for repayment at lower interest rates.

Indian consumers prefer instalment loans/EMI when purchasing products

Consumers in India have always been inclined towards purchasing on EMI/BNPL. According to a brand that sells on Amazon, about 30% of goods above Rs. 5,000 and 40% of goods above Rs. 10,000 are bought on EMI. In fact, most of Apple’s products are sold on EMI in India.

One of the pioneers of EMI in India is Bajaj Finance which started in the late 1990’s to provide financing for auto wheelers and quickly expanded to consumer durables, property and SME financing. Today, it is a dominant player in the consumer durables market at offline retail stores for goods typically worth Rs 10,000 to Rs. 1,00,000 with over $2BN in Assets Under Management. In the past few years, in the offline modern retail, BNPL has become the go to method for transactions as banks, NBFC’s and brands have been offering EMI options to consumers via POS terminals. According to Bernstein, Bajaj Finance does about $8-9BN instalment loans for in-store purchases. The question remains - who can capture the online market for pay later products?

The BNPL market especially in India can be divided into two buckets –

Rs 10,000 – 1,00,000 purchases – In this range, the purchases are typically higher value goods like TV, refrigerator, and smartphones. Consumers that are buying these products using BNPL as a payment method buy it primarily for the credit requirement rather than convenience. Majority of these products are mainly sold at a pre-determined interest based EMI.

Rs 0 – 10,000 purchases – In this range, the purchases are typically lower value goods like apparel/fashion, food, personal care and consumer electronics like earphones. Consumers that are buying these products using BNPL as a payment method do so for convenience rather than a dire credit need.

For this discussion we are focussing primarily on the Rs 0 – 10,000 purchases on e-commerce channels

Marketplaces will opt for white label BNPL whereas digital first brands will opt for the BNPL native apps

Today, the bulk of e-commerce transactions taking place in India are the big marketplaces. To ease the checkout process, these marketplaces invest in a fintech layer to retain customers on the platform. Players like Amazon and Flipkart have already started to offer white label BNPL products. White Label BNPL are products which are often termed as the “Flipkart Pay Later” or “Amazon Pay” but the undertaking, servicing and collections are taken care by other lenders like Banks and NBFC’s (Capital Float, ICICI Bank, IDFC Bank) rather than Flipkart or Amazon. Even food delivery apps like Swiggy have launched a wallet under the name Swiggy Money and is rumoured to launch a BNPL product as well.

While the presence of native BNPL apps on marketplaces is necessary for customer retention, the majority of the share or promotion by marketplaces will over time go to white label BNPL - Amazon will heavily promote "Amazon Pay Later" while also offering other BNPL checkout options.

The next peg of growth and demand for the BNPL apps is from new and upcoming digital first brands rather than marketplaces.

Digital first brands in India are growing at a rampant pace today. In fact, during the first 6 months of 2020 the number of brands in India opening a store on Shopify grew by 123% YoY. Newer brands are launching in India at a faster pace than ever before and older brands have realized that they need to be present everywhere – offline, online marketplaces as well as have their own website.

The different forms of BNPL options available on a brand/merchant’s page that a consumer at the checkout page can use –

· Credit cards

· EMI on Cards powered by banks like ICICI, HDFC, Kotak

· BNPL apps like Simpl, LazyPay, Zest, Bullet, Paytm and many more

Today, UPI is by far the leading market share holder at 40% for payments on ecommerce platforms in India. Followed by debit and credit cards which are losing share along with cash on delivery. BNPL saw a tremendous growth from 1.6% market share in 2019 to 3% in 2020 and is expected to grow to 9% by 2024. In fact, Razorpay claimed that in November 2020 the BNPL transactions grew by 183% YoY on its platform.

So how will credit on UPI evolve? Do we really need cards? If BNPL is levied on top of UPI with merchant integration – how big can BNPL get?

Tailwind for BNPL - Rapid growth in E-commerce is expected in India in the next 5 years

According to Goldman Sachs, the e-commerce penetration in India is expected to double to 11% from 5% in 2020 - making India one of the world’s fastest growing e-commerce markets.

The online market size of some of the categories below <10,000 in value is well over $10BN+

Source - Redseer

Some of the leading BNPL companies in India today and what they offer –

* Zest Money is another BNPL player that we haven’t included as it primarily operates in the Rs.10,000 – Rs.100,000 segment

Economic model of BNPL -

|

Rough unit economics of BNPL |

|

|

|

% of GMV |

|

Revenue |

|

|

Merchant Fee |

2 - 8% |

|

Late Fee |

1 - 2% |

|

Expenses |

|

|

Net Transaction Losses |

1 - 5% |

|

Cost of Capital |

0.5 - 1% |

|

Servicing Costs |

<1% |

|

Marketing Costs |

<1% |

They key revenue drivers for BNPL businesses are –

Merchant Fee – (2 to 5% of GMV) – BNPL as a product is designed in a way where the bulk of the revenues will come from the merchant and brand integrations - often called as subvention in India. This subvention model is one of the key revenue drivers for the incumbent - Bajaj Finance as well where it monetizes via brands or retailers.

Now, in online retail most of the consumer brands operate at high gross margins, about 40%+ in industries like consumer electronics, apparel, personal care, and home goods sectors and we predict that this is where the bulk of the revenues can be made. The value proposition of increase in revenues is clear for the merchants and with the increase in digital first brands one can expect merchant fee to be upwards of 2%+. But, as the industry is nascent bulk of the merchant fee is sub 2% today.

Late Fee – (1 to 1.5% of GMV) - Late fee is penalizing the customer for missing a payment. This form of revenue channel cannot be very high because it then translates into high net transaction losses. An average BNPL should optimize for keeping this at sub 20% of total revenues and lower than 2% of GMV.

The four key cost line items that BNPL apps need to control are – Net Transaction Losses, Cost of Capital, servicing (collections, disbursals) and marketing

Net transaction losses - (1-5% of GMV) – Net transaction losses is defined as the amount that hasn’t been paid back in 60 days by the consumer. In India, one of the leading costs for lending apps is the default rate. As India is a credit poor nation with most users being first time credit users, the apps need to be careful about whom they’re providing credit. The BNPL player needs to invest heavily behind the technology that is using either a CIBIL score or alternative data to better predict the consumer ability and willingness to repay the outstanding credit. As the target market is a consumer base that is using the product more for convenience than anything else, this should lead to lower default rates. As a benchmark, the BNPL players need to keep the net transaction losses lower than 5% of GMV because above 5% the margins turn sour

Cost of Capital – (0.5 - 1% of GMV) - Today, most fintech’s cost of capital range from18-24% per annum. The way to make this work for no interest BNPL companies is to ensure that the customers are increasing the frequency of the purchase. If the user that has access to a Rs.10,000 credit line for 15 days and utilizes over 70% of it on a regular basis, the cost of capital significantly comes down.

Servicing costs (<1% of GMV) – This includes costs like repayment, reminders, disbursals and MDR on the transaction and can range from 1 – 5% per transaction. If most of the repayments takes place via credit cards where the MDR is 2% then the chances for the company to make money on every transaction are slim. If the repayments, are primarily done by debit cards and UPI the costs is lower than 1%. Other costs like SMS reminders, servicing and call centre costs will decrease as BNPL reaches scale.

Marketing (<1% of GMV) – In the initial days, marketing is important to attract both the merchants as well as the consumers. Without the consumers, merchants will leave the platform and without the merchants, consumers will leave the platform. This makes it super important to ensure that enough consumers and merchants are available to keep transactions going. In the initial days, the BNPL players may have higher marketing costs but at scale it’s important that the marketing costs stays below 1% of GMV.

For the unit economics to work, especially in the less than Rs. 10,000 BNPL market it’s important to maintain high customer and merchant retention on the platform. Furthermore, without the frequency of transactions by users on the platform, the BNPL player will not make money. For context, Afterpay, has a user frequency of 25 transactions per year and a user spends an average of $150 (Rs 10,000) per order.

BNPL apps will take a bigger chunk of pay later market than the credit cards

In just five years, UPI has become ubiquitous with over 150MM users and a leading payment method in the country. In December of 2020, UPI P2M (Person to Merchant) value of spends $9.6BN overtook the value of spends on debit cards ($8.6BN) and credit cards ($8.4BN) for the first time. With UPI becoming the most convenient payment product in the country, it’s only time that a credit layer on top of UPI increases usage and reduces requirement for credit cards.

While the affluent and mass affluent will still continue to have and use credit cards, we believe that a good chunk will also start to use the BNPL apps in the coming decade for e-commerce transactions due to its convenience. A further headwind for the credit cards industry in the coming months will be in the form of additional friction to complete recurring payments as every month an OTP will be required to complete a payment.

Data from SBI cards usage suggests that users spend Rs 3,500 per transaction, Rs 120,000 per year and about 40% of the spend is online. If the similar type of behaviour is seen on BNPL apps, which offer Rs.10,000 credit for 15 - 30 days, the relevance of cards will decline.

Conclusion

In conclusion, ‘pay later’ is a product that will always be needed as it allows for instant gratification purchases and reduces guilt by not having to pay for everything today while also helping provide credit to those who need it. No interest BNPL has the potential to be the go - to ‘pay later’ payment method for e-commerce transactions less than Rs. 10,000 in India. The faster, frictionless and credit payment method gives the consumer a sense of trust in the platform to transact. This is especially important in a country that lacks trust and where cash on delivery is one of the highest forms of payment. The tailwinds for the BNPL sector can take advantage of the headwinds in the credit cards sector and solve for the high fees and interest rates.

BNPL is still in its nascent stages with low average transaction value and frequency, however, this industry has seen some massive acceleration due to COVID and with rising e-commerce penetration, BNPL is a fascinating industry to look out for in the near future.

If you’re building in this sector we would love to speak with you. Please feel free to share your thoughts and feedback on this sector at research@lightbox.vc.