Apollo and Medplus have strong store economics and significant scale However, despite their scale and profitability, their current store economics do not support providing discounts upto 60% on trade generics. Since discounts of at least 10% at the pharmacy level have become normalized, retail chains will also attempt to move revenue share from branded to trade generics to offset the margin lost from discounting.

It is probably safe to say that most people reading this have heard about the issues that plague the Indian healthcare industry (distrust of institutions, high out-of-pocket expenditure, and lack of affordability of medicines, to name a few). And if you’ve read our earlier blog on the pharmaceutical market in India, then you are also aware of the mis-aligned incentives that exist in the pharmaceuticals supply chain that partly cause and / or exacerbate the aforementioned issues. Here’s a quick refresher for those who didn’t do the “pre-reading”:

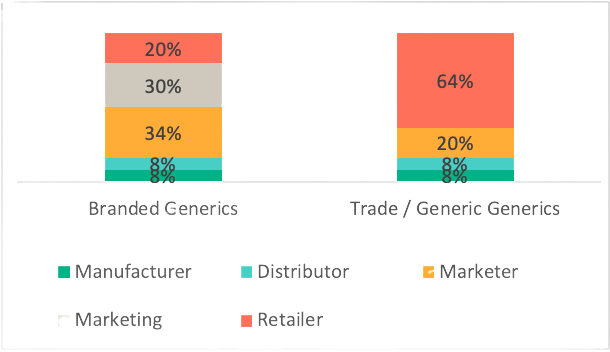

India is a generics market by law. Patent regulation in India is only applied to the process by which a drug is made and not on the product itself. One of the reasons behind this decision was to decrease the chances of monopolization of a molecule and / or drug, and subsequently, increase the availability and affordability of medicines. However, in order to sell their products in a commoditized market, Indian pharma companies began branding their generic medicines. These pharma-marketers incentivized intermediaries in the value chain to sell their brands (see Chart 1 below), and led to the creation of “branded generics.” Branded generics are medicines where the pharma-marketing company (Cipla, GSK etc) takes on the onus of moving the product off of the pharmacy shelf, thereby only passing a limited margin (20%) to retailers. There is another channel through which generics are sold where the onus of selling the medicine rests on the pharmacy / the retailer. This is known as the trade generics channel, and as you see in Chart 1, retailers are incentivized with higher margins to sell trade generics. For example, Shelcal, marketed by Torrent Pharma, is a branded generic drug for Vitamin D deficiency, that is often prescribed by doctors. It has the exact formulation as the trade generics version, Cipcal, which is sold by Cipla straight to the pharma-retailer. If they are both sold for Rs 100, then retailers would receive 20% or Rs 20 for every Shelcal sold vs. 64% margins or Rs 64 for every Cipcal sold.

Chart 1: Margin Structure of Branded vs. Generic Generics

There are roughly 1M pharmacies in India that can be split between the unorganized sector (independent pharmacies) and the organized sector (retail chains and e-pharmacies) and both branded generics and trade generics are sold through pharmacies. However, one channel is a “pull” market (the brand and various intermediaries are responsible for generating sales), while the other is a “push” market (trade generics are often unheard of, and therefore retailers have to “push” sales in this channel).

Despite receiving limited margins on branded generics, nearly 90% of pharma-retail revenue comes from this segment because retailers do not have to generate demand for branded generics. Furthermore, it is difficult to convince a consumer to switch out a branded generic that was prescribed to them by their doctors. Moreover, the trade generics supply chain is broken, which makes it difficult for the average pharmacy to increase the revenue contribution from trade generics (more on this later). In fact, since branded generics are able to command a premium and inflate prices of medicines, consumers don’t benefit from the advantage of these medicines being generic (oxymoron much…). Unfortunately, the consumer plays no part in the decision making to manufacture, market or sell generics, a market, which ironically, was set up to benefit them. That is, until Zeno entered the market.

Zeno Health is revolutionizing what it means to be a truly customer-first business, and has proven that customer-centricity is a sustainable competitive advantage in a crowded market.

By building from a first-principals approach, Zeno has prioritized the customer in every step of their journey. Their business model rests on two pillars that generate consumer trust:

1) transparency and

2) sharing value

Zeno sells generic medicines as they were intended to be sold, as generics, and by sharing the trade generics margin with consumers, the company saves consumers on average 65% on their medicine bills. What’s more is that they are doing this at scale – with 100+ omnichannel enabled stores in Mumbai and Pune, Zeno has delivered more than 175Cr of savings to customers (~$25MM) in the last three years.

They want to solve the fundamental problems consumers face in healthcare today – cost. 70% of healthcare expenditure in India is out-of-pocket, and 53% of that is spent on medicines alone. In fact, roughly 50M Indians are pushed into poverty every year due to high expenditure on medicines. To make healthcare more affordable for Indians, Zeno re-imagined the traditional pharma value-chain. For the first time, customers were educated on the molecule behind their medicine, and informed that the brand is levying a premium on a widely available product. By solving for the information asymmetry in the industry, Zeno empowered their consumers with the knowledge that high-quality generic alternatives are available to them, thus enabling substitutions from branded generics to trade generics.

Moreover, through a series of business model innovations, Zeno is able to share significant value from their margin with the consumer in a sustainable way. This is because they have disintermediated the traditional pharmaceutical supply-chain and replaced the pharma-marketers, and other intermediaries by going straight from manufacturer to consumer, ensuring a consistent supply of trade generics at their stores. Supply consistency is only possible because of the technology they have built to manage their operations and inventory. Their back-end infrastructure is able to predictably forecast demand and is integrated deeply into the trade generics supply-chain and distribution network.

More recently, they opened their own warehouse and are now able to stock greater quantities of trade generics, which not only increases margins over time but also improves fill rates (currently over 90%). While Zeno also sells branded generics at their stores, their inventory management systems are accompanied by a proprietary database of “substitution” technology, which allows for pharmacists to easily suggest the best trade generics substitutes for the branded generic counterpart with less than <0.001% error. These systems work so well that the company is able to convert >78% of all possible substitutions from branded generics to trade generics.

If you’ve made it this far in the blog, you’re probably wondering why other pharmacies are unable to do this as effectively as Zeno can… Read on to find out ![]()

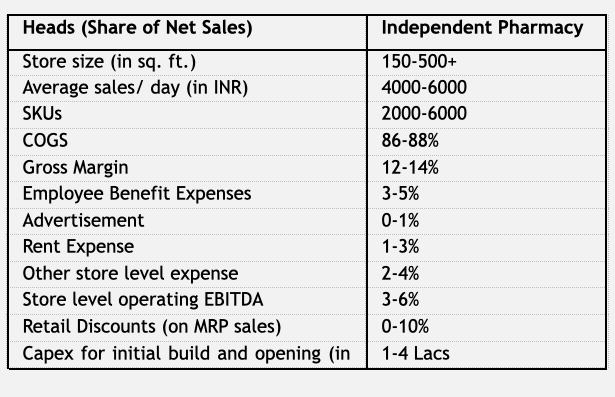

Let’s start with the independent pharmacy (mom & pop shops). These are family run medical stores that generate sales of roughly Rs 15L – 30L per year and operate at 3-6% store EBITDA (see chart 2). Although they are customer-centric to a degree – they are able to quickly address acute healthcare needs by 1) developing a relationship with you and offering products on credit and 2) same-day delivery for those who live close by – they are unable to offer discounts greater than 10%.

While they receive a higher margin by selling trade generics (refer back at Chart 1), they are likely to keep as much of that margin for themselves and not pass on value to the consumer. This is because their own margin profiles are limited as they do not have the benefit of economies of scale to buy, stock and manage inventory effectively. Unfortunately, bad inventory management leads to a number of issues such as low fill rates and stocking of unreliable or expired medicines. Moreover, because of the lack of access to working capital, independent pharmacies have less readily available supply (2-6,000 SKUs) vs. organized pharmacies that can stock 4000-10,000 SKUs.

Unfortunately, even if these pharmacies wanted to sell more trade generics, they would not be able to do so successfully because the trade generics supply chain is broken and unpredictable. Pharma-marketers like Cipla or Sun-Pharma make a majority of their revenue from branded generics. In fact, trade generics are manufactured only when there is spare capacity in their factories unless the medicine is sourced from exclusively trade generic manufacturers. Thus, without the benefit of technology for both inventory management and forecasting of supply and demand, these independent pharmacies are not able to consistently sell trade generics at their stores.

Chart 2: Independent Pharmacy Retail Economics

Source: Technopak

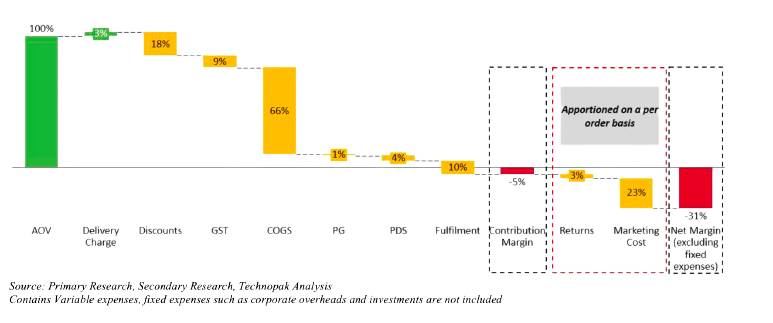

On the other hand, the organized sector, made up of e-pharmacies and retail chains, can better manage inventory, build out their own supply-chain and offer trade generics to their customers. However, the current e-pharmacy model is unprofitable. Their net contribution margins (post marketing and returns) are on average -30%. Due to the low gross margins they receive from selling branded generics (roughly 20%), and the 15-20% discounts they offer to every customer, e-pharmacies are, on average, CM1 negative as well.

Chart 3: E-pharmacy unit-economics

Eventually, to generate profitable unit economics, these companies will need to do away with the discounts, and as a result, won’t be able to offer affordable branded generics at attractive prices on their platforms. Thus, in order to serve their customers better, e-pharmacies will look to increase their share of trade generics. However, since trade generics need to be “pushed” off of retail shelves, it will be difficult to convince a customer to switch from branded to trade generics online. E-pharmacies can solve for this is by 1) spending on marketing trade generics to build trust, and 2) building out an assisted sales model that can facilitate substitutions from branded to trade generics. While this may seem promising, the economics of these marketing and sales efforts and the effectiveness of encouraging substitution without an offline touchpoint is yet to be tested.

Separately, omnichannel retail pharmacy chains like Apollo and Medplus have strong store economics – 8-10% store EBITDA margins at significant scale (<2,000 outlets each). However, despite their scale and profitability, their current store economics do not support providing discounts upto 60% on trade generics. Since discounts of at least 10% at the pharmacy level have become normalized, retail chains will also attempt to move revenue share from branded to trade generics to offset the margin lost from discounting. These companies will find it increasingly difficult to compete with Zeno’s low prices because their stores are located on high-streets, have rental spaces and have higher operating costs Therefore, they will have to substantially scale their volumes per store to sell trade generics at the same discounted costs as Zeno in order to remain at their current levels of store profitability. On the flip side, Zeno’s store set-up costs and OPEX are lower than that of Apollo and Medplus. Zeno stores are smaller and cost-effective, operating at <2.5% of monthly rentals vs. the 5-10% of their competitors. Their lean business model enables Zeno to pass a significant amount of the value from the retailer’s margin to consumers.

Moreover, while e-pharmacies provide convenience for their customers, Zeno’s omnichannel model is much more effective at meeting their customers wherever and whenever they need to buy medicines. Offline stores not only help provide education to facilitate substitution from branded generics to trade generics through a high-touch model, but also serve as a beacon for the brand, bringing in more organic customer acquisition. Zeno currently spends 4% of net revenue on marketing every month, and has best-in-class store metrics (ex. The average Zeno stores sees Rs 1.1 lacs in GMV per square foot per month). It is clear to us (and to the industry) that the omni-channel model is the only path to profitability for the pharmacy-retail industry, In fact, according to Apollo Pharmacy in their recent earnings call, "this is the age of Omni, unless you can back digital with physical, there is no future or path to profitability.” Zeno is best positioned to capture the omni-channel customer spend because they have already established customer trust and their high-density offline strategy allows them to deliver faster than their online counterparts.

As of now, Zeno is employing the only business model at scale that can sustainably pass on significant value to their consumers, and solve for real customer issues. It is clear that the 400K+ consumers they serve per month are noticing and appreciating this value proposition – 83% of revenue generated is from repeat users.

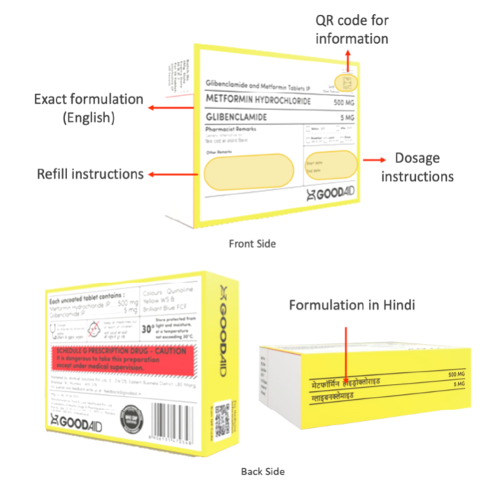

Zeno is also able to provide greater transparency to customers in their healthcare journeys. Most consumers are unaware of the existence of trade generics. Zeno’s proprietary substitution technology allows their pharmacists to educate consumers, but in order to further this value proposition, Zeno launched their own high-quality generic medicines, made by India’s top manufacturers, under the brand “GoodAid.” GoodAid offers greater transparency and value to consumers by innovating on a number of levers - one of which is packaging. Their medicine packaging promotes the generic name of the drug in English and in regional languages, educating consumers on the molecule and generic nature of their medicines. Their packaging also provides dosage, and refill instructions, amongst other important health-related information.

GoodAid’s success is proof that Zeno’s customers have placed their trust in them. The brand has scaled incredibly well – in the four months since they launched their first 50 SKUs, GoodAid sales have contributed to more than 10% of Zeno’s GMV. In fact, through GoodAid, Zeno is able to pass even greater savings to customers (an additional 10% on top of the 40-60%) because of the higher margins they capture by sourcing directly from manufacturers.

Chart 4: GoodAid Packaging Innovation

Lastly, Zeno’s model is well-aligned with how the government is thinking about the evolution of the pharmaceutical market in India. In 2008, the government launched Jan Aushadhi, a project with the objective of making quality generic medicines available at affordable prices, especially for those who cannot afford medicines at all. By 2021, the government launched over 8,000 Jan Aushadhi stores in parts of the country where little to no infrastructure exists.

Zeno’s commitment to providing a consistent supply of affordable medicines is a highly-valued mission from both a consumer and public-sector lens. Zeno’s innovative business model proves that companies can operate with a compassion-first mindset whilst generating great revenue traction and profitability. It is not only re-imagining the pharmaceutical value-chain, but it is also redefining what building with customer-first mindset truly means.