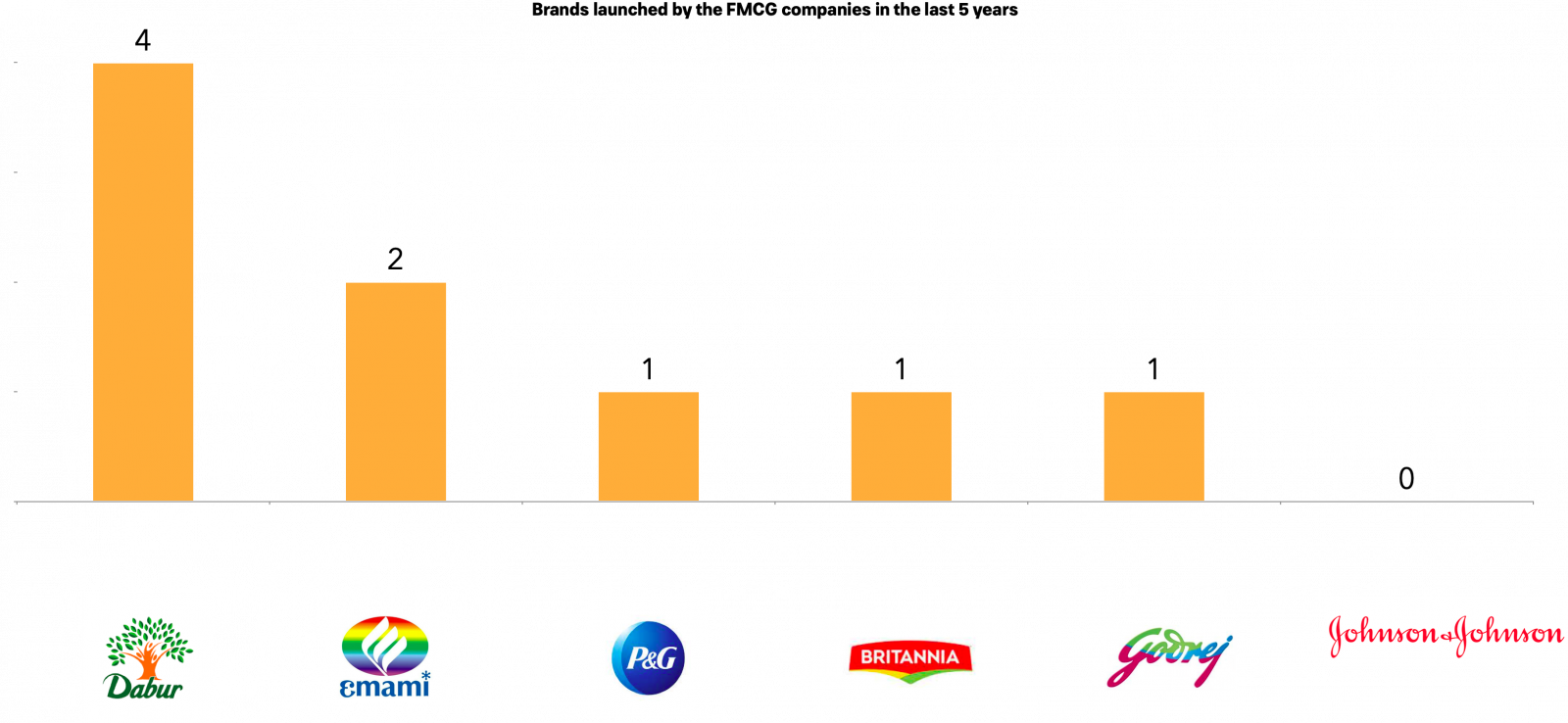

Of the $18BN BPC market, the top 10 FMCG companies comprise over 30% of the market. The 8 major brands are owned by 3 FMCG giants- Unilever, P&G, and L’Oreal. These 3 companies have a combined age of 388 years. Take a moment to think about these seemingly contradictory facts- in a sector where companies have 4 centuries of experience, how have 80+ brands come up in the last 5 years? Why can’t the legacy brands keep up? We try to answer these

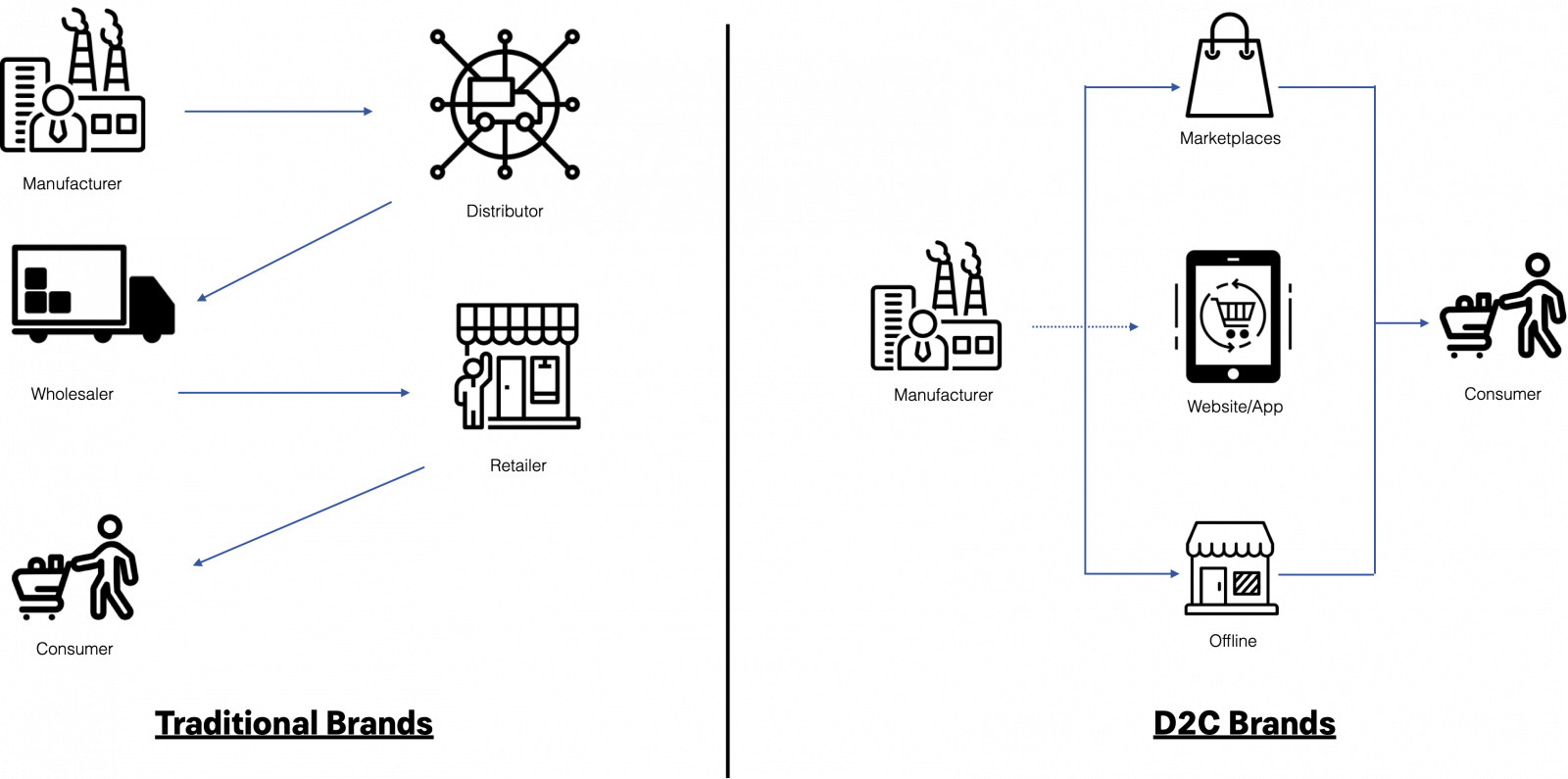

What is your skincare routine? How many steps does it have- 3? 5? 7? If your answer is 0, don’t worry, a lot of us are right there with you. Personal Care brands have taken India by a storm not just because of their products, but also thanks to the stories and values they have embedded within their brand. This increasing popularity of ‘Skinfluencers’ and personal care regimes in mainstream pop culture is all thanks to the rapid rise of these new-age, ‘Internet-first’, D2C brands. Let’s break that down: ‘Internet-first’ owing to their digital distribution channels and ‘Direct-to-Consumer’ due to the lack of distributors, wholesalers, and retailers in the supply chain.

Building brands: Traditional v/s D2C

We’re not kidding when we say rapid- in the last 4-5 years, 80+ brands have been built in the Beauty and Personal Care (BPC) space in India. We believe the D2C BPC market is probably the most crowded space for Venture Capital money to flow into. More competition leads to newer products, leading to a more pressing need for differentiation. In any case, the Indian consumer is winning. Gone are the days where Shampoos only meant Head&Shoulders, Pantene, ClinicPlus, the only soaps available were Pears, Lux, Lifebuoy, and face washes were limited to Dove and Garnier (If we’re being honest, Coconut Oil still remains largely synonymous with Parachute’s blue bottle). All of these are household names. You see, personal care products are largely ubiquitous in India and command a significant mindshare.

They are also extremely consolidated. Of the $18BN BPC market, the top 10 FMCG companies comprise over 30% of the market. All the 8 brands mentioned in the last passage are owned by 3 FMCG giants- Unilever, P&G, and L’Oreal. These 3 companies have a combined age of 388 years. Take a moment to think about these seemingly contradictory facts- in a sector where companies have 4 centuries of experience, how have 80+ brands come up in the last 5 years? Why can’t the legacy brands keep up? Within those new D2C brands, how many can scale? What are their niches? And the golden question(s)- what is the differentiation, how do we spot it, and where is the whitespace? We tried to answer some of those questions here. Unfortunately, we couldn’t find any solid answers to the best skincare routine.

This entire piece could be summed up succinctly in one single quote-

“Never has it been easier to launch a brand, and never has it been harder to scale it”

The launch: Never has it been easier to manufacture (Zetwerk), advertise (Instagram, Google Ads), setup payments (RazorPay), distribute (Amazon, Flipkart), and deliver (Delhivery, ShipRocket) your product. The total D2C addressable market in India is estimated to be worth $100BN by 2025. 600+ D2C brands have been launched between 2016 and 2020 in India.

The scale: Out of these 600+ brands, only 45 (7%) have crossed the Rs 100Cr+ ARR mark. Out of these 45, only 5 are in the BPC space. Further, only 16 (3%) of these have reached the Rs 400Cr+ ARR milestone. Only 3 within these are in the BPC space

Indian D2C brands market map

Nonetheless, there are no two ways about it- the D2C market is flourishing in India. The Indian growth story and shift in consumer behavior makes it an exciting time to be an 'Internet-first’ brand in India. We believe this meteoric rise of D2C in the last 5 years can be understood through 3 lenses: Market, Consumers, and Incumbents.

The Beauty and Personal Care space is massive. It is made up of Skin Care, Hair Care, Men’s Grooming, Cosmetics, Perfumes, and Nutraceuticals. For this discussion, we wanted to focus primarily on brands in the Personal Care (Skin Care + Hair Care + Grooming) space.

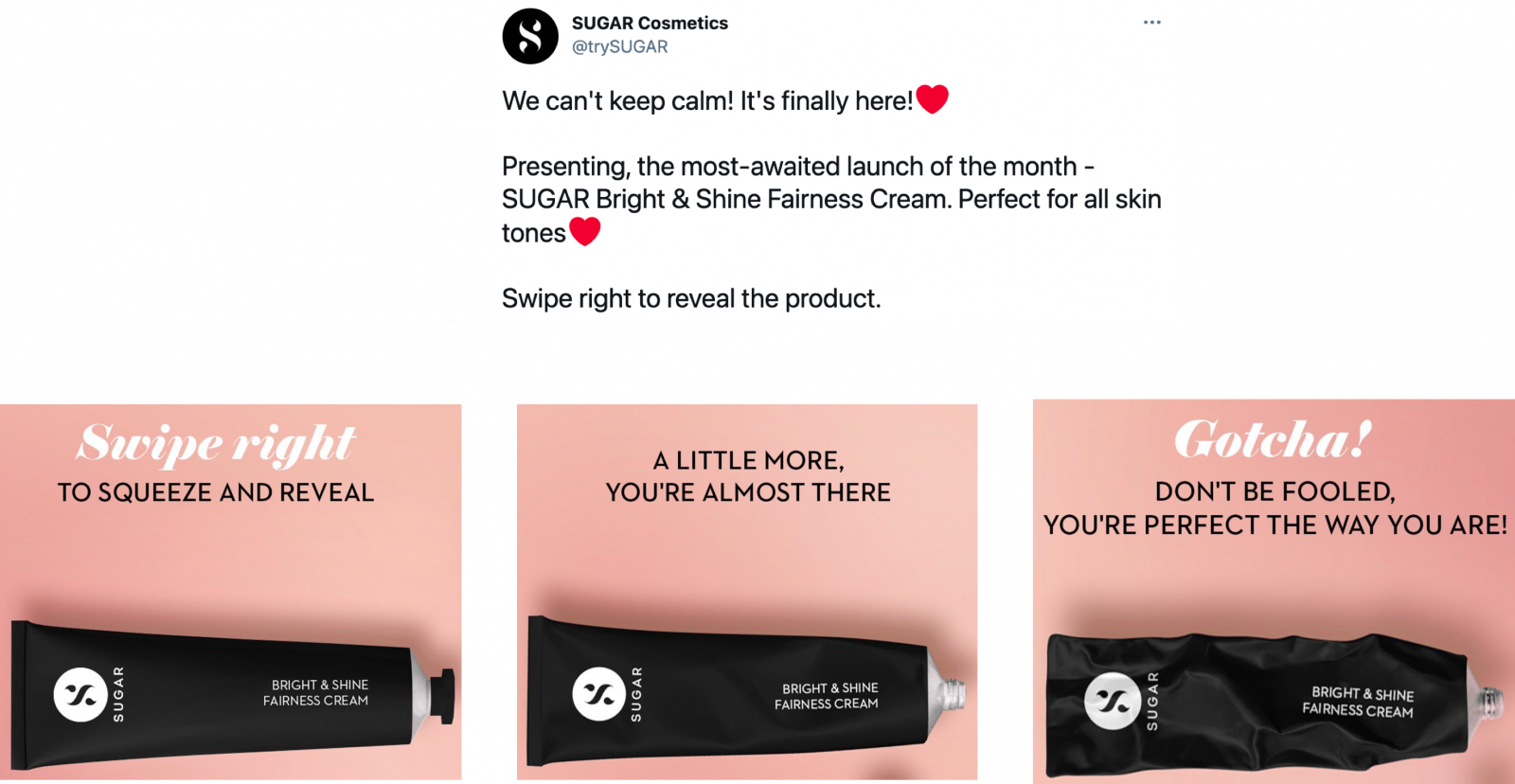

New age D2C brands have a strong set of values at the core of their brands

Although the single biggest factor, especially in BPC, has been the rise of women shoppers. In 2020, women constituted 44% of online shoppers, up from 10% in 2016.

New brands launched by legacy FMCG companies in the last 5 years

An increasingly online BPC market, a highly aware and value-driven consumer, and legacy players struggling to innovate to keep up with this new demand creates the perfect storm for the rise of D2C players in the Personal Care space.

Launching (and differentiating) a D2C Personal Care brand

Now that we have established what D2C brands are and the sudden interest in them, let’s actually look at what makes one a winner. We have observed some common characteristics across all Personal Care brands:

Entering the Market

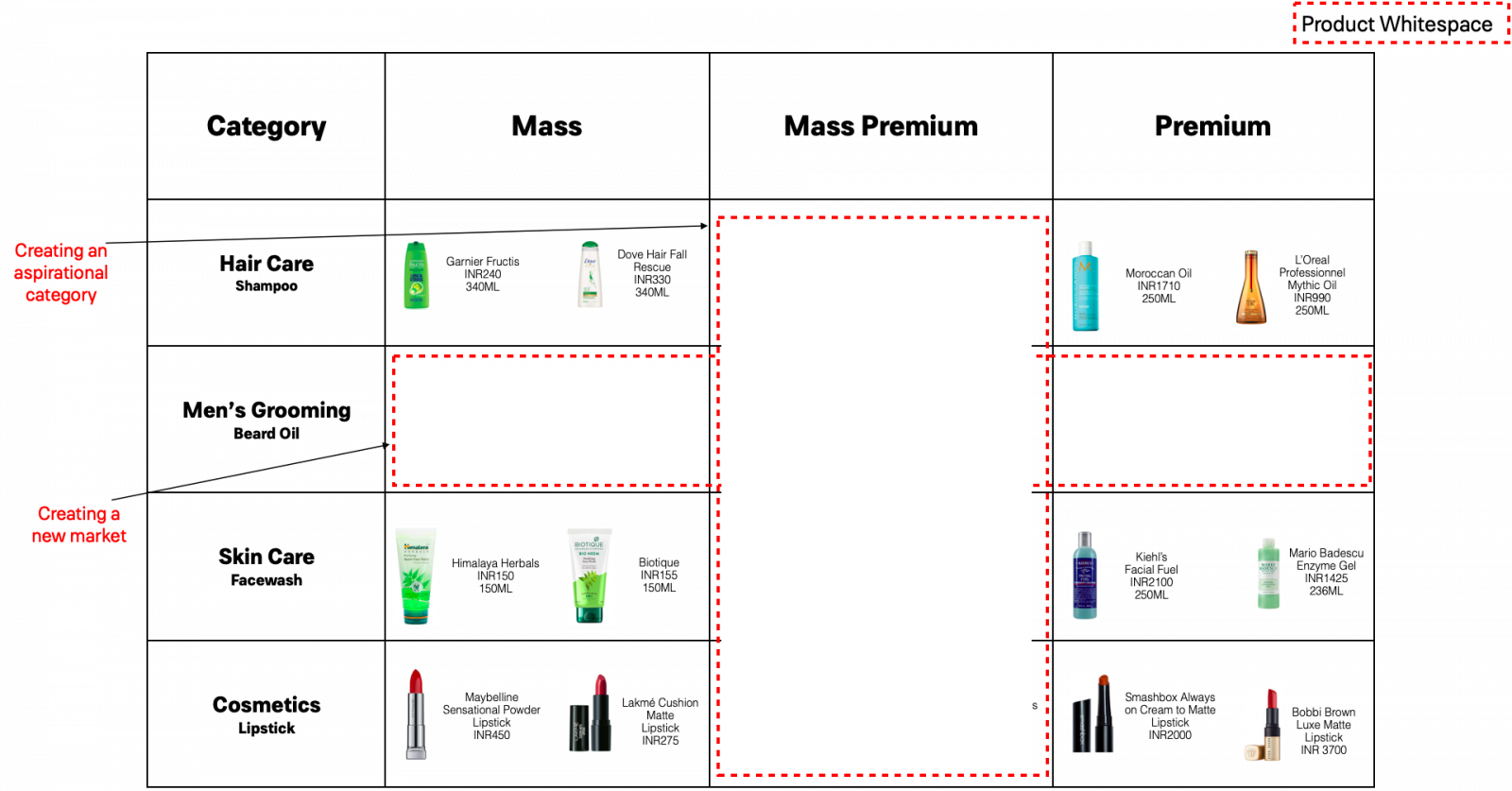

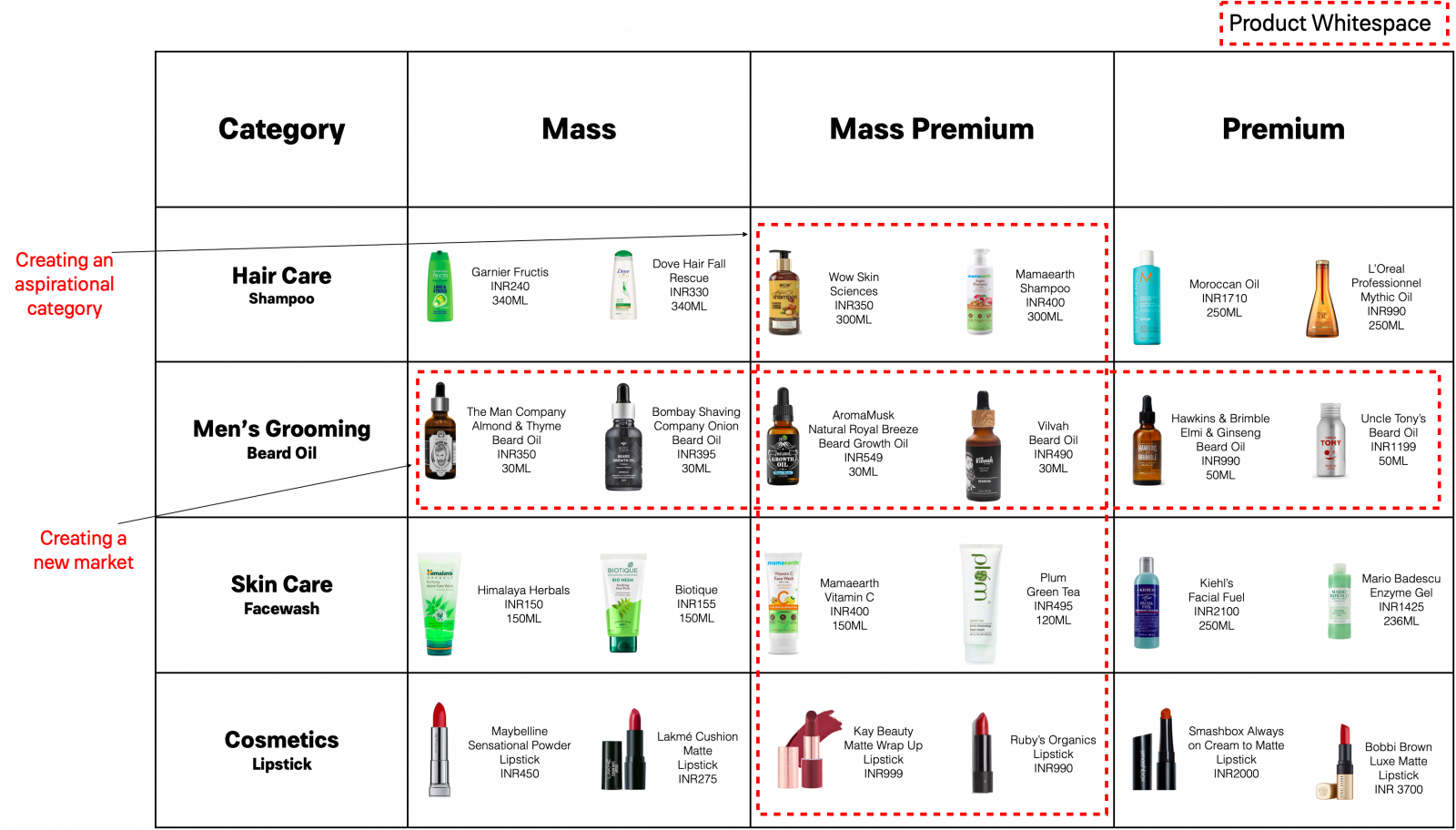

Thanks to rich customer data being available directly, D2C brands have a sharper understanding of their customers. The initial differentiation from the incumbents is stark in the first step itself- product innovation and go-to-market strategy. To stand out in this crowded space, they have a two-pronged approach while identifying product white space. This picture might help:

Product Whitespace in the Indian BPC market: Mass Premium segment + nicher offerings

Vertically, from an ASP perspective, products across categories can be segmented into mass, mass-premium, and premium. Incumbents are comfortably placed in the extremes. They have played largely in the mass (Rs 150-350) category, especially in India, and it is an extremely crowded space with little price difference and innovation. Due to their house of brands approach, they also have the luxury to have companies that operate in the other extreme: luxurious, premium products (Rs 1,500+). What they fail to realise is that the new age customer, the millennials, are super aspirational. They want to elevate themselves from the mass-y products, but can’t afford spending Rs 1500+ on a shampoo. Where do they go?

Enter D2C brands: they came in and created a new, aspirational category in the Mass-Premium (Rs 350-1,000) segment. Perfect price segment + relatable marketing + aesthetic labels truly resonated with these consumers.

D2C brands have filled up the product whitespace incredibly well

Horizontally, they have created a new market using new niches, ingredients, and trends that the incumbents simply don’t have. No legacy brand in India is currently selling Vitamin C Serums, Beard Oil, Niacinamide Serums, Retinol Creams, or Apple Cider Vinegar, Onion, and Tea-Tree Oil face washes.

It’s easy to figure out product and brand differences between incumbents and D2C brands. But what about within D2C brands? That is where things get tricky.

Differentiation within D2C: Products and Brand Positioning

It is quite counter intuitive, but we have observed that in an industry where you’re known for your product, the product itself becomes highly commoditized within D2C BPC brands. Due to contract and third-party manufacturing being the go-to options, a lot of the top brands often have the same manufacturer for the same product. To add to this, since none of the new-age brands talk about or mention efficacy, the buying decision becomes further qualitative.

Same product, different story- what is your pick?

Thus, this decision is often driven by the intangible assets of the brand. We believe that comprises of:

Intangible assets of D2C brands: Niche, Brand story, Hero ingredient, Product aesthetic

This makes it harder to gauge the scalability and success of a brand because qualitative decisions are largely subjective. We feel this also makes investing in these brands difficult, especially in a later, Series A+ stage. What resonates with us in a niche and aesthetic product, might not appeal to the larger crowd.

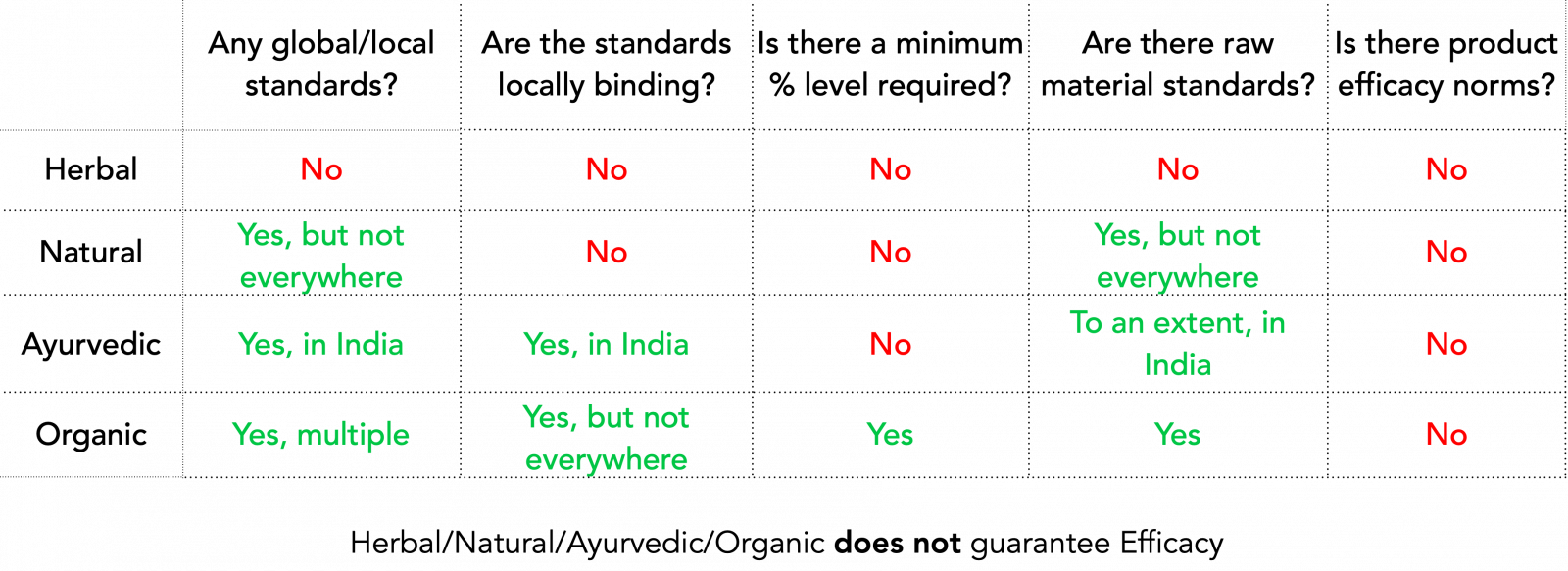

After talking to some customers, we realised that Customer Repeat and Retention, are the two north star metrics in this sector and are often driven purely by efficacy. While there is an entire gamut of hero ingredients, brand stories, niches, and aesthetic labels, there is no real talk of efficacy. Instead, claims of the brand being organic, natural, ayurvedic, and herbal are incorrectly taken as a proxy for the product having efficacy. We saw these claims across a whole host of brands- but are they really binding? Who enforces them? The answer was disappointing. While the domestic and international certifications are definitely a solace, other claims are simply that- claims. There is nothing binding about them and no one seemingly cares.

Claims of the brand being organic, natural, ayurvedic, and herbal are largely not binding

Thus, the real differentiator in this space are all intangible assets of a brand: their niche, brand stories, values, hero ingredients used, and their aesthetic.

Leveraging Digital Marketing

For D2C brands, the cycle from acquisition to retention is starkly different when compared to legacy brands. 'Internet first' brands are socially active and recruit customers online. They realise the significance of trust in the buying decision and user generated content by influencers is a great proxy for trust in the brand. This translates into having a separate budget for influencers and online channels and striving to have an online community across platforms. We actually did a deep dive into the social commerce space here. Direct to consumer also leads to prompt responses to queries- this increased responsiveness also leads to a better connect, and hopefully, higher customer retention.

Check out these 30 second ads from Fiama (an ITC brand), Mama Earth, and The Minimalist to understand how each brand takes a different approach to talk about its products and emphasizes on different aspects of their brand in the same time frame.

Agile Product Innovation and Manufacturing

Simply put, we have observed that these brands move incredibly fast and have very little downside while doing so. Let’s break that down:

Finally, to answer the original question of differentiation, it still remains quite elusive. But there’s a lot to learn from how different brands created their small nuanced differences as they grew. We summed up our learnings here:

|

Categories |

Questions |

Example |

Amount Raised |

|

Niche |

What is your Go-To-Market niche? |

MamaEarth: Started as one of the first toxin-free personal care for mothers and babies promoting the feeling of overall ‘wellness and goodness’ |

$23.5MM |

|

Are there other players operating in the same niche? |

MamaEarth: Back in 2016, this was an untapped niche |

||

|

Brand Positioning |

What is your brand positioning and story? |

Forest Essentials: Ayurvedic products have never really been seen as a ‘luxury’. They decided to adopt a premium, aesthetic approach to this space |

N/A |

|

What is your approach to your niche? |

The Minimalist: Scientific and clinical approach to beauty |

N/A |

|

|

Price Point |

What segment are your products in? |

Wow Skin Sciences: Masstige. Aspirational products were in dearth in India when it began |

N/A |

|

Manufacturing |

How long is your product cycle? |

Example: 2-3 months |

$2MM |

|

Loyalty |

How much is your repeat %? |

Example: 45% |

|

|

How are you building an online community? |

Beardo: Runs a virtual marathon to engage with user base |

$46MM |

How to find the elusive differentiation?

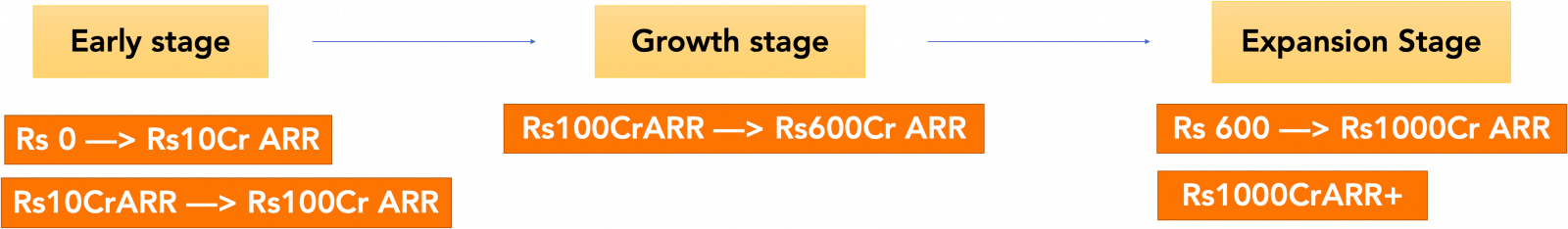

For BPC brands, revenue is the perfect yardstick in understanding the scale of a company and assessing the company’s subsequent growth strategy. We divided the companies’ journey into 3 major stages: Early stage, Growth stage, Expansion stage and tried to create our own playbook around checklists at each stage. Of course, this is by no means a definitive or an exhaustive list.

Different stages of growth for D2C brands

1) Early Stage

2) Growth Stage

3) Expansion Stage

Different expansion stage strategies for D2C brands

While yes, it has never been easier to launch a D2C brand, it has also never been harder to launch a differentiated one. Evident by the several ‘me too’ brands, as time goes by, it is harder to find a subset in the personal care space that hasn’t been explored before. We believe in 2021, the biggest headwind remains this: upstart brands in BPC need to find a niche within a niche to have a differentiated proposition at launch. Here are some of our other observations:

Despite how crowded the market looks right now, there are a lot of unexplored, underpenetrated opportunities we’re keenly tracking. When looked at through a global lens, it seems about time some of these trends show up in India, considering how nascent the D2C BPC market is here. Here’s what we’re excited about:

As ConsumerTech VCs, we have always been excited by everything Consumer and have been keenly tracking Personal Care space’s growth in the country. We believe this new DNA of brands emerging in the form of Direct-to-Consumer is the future of consumption and commerce in India. We already have a handful of them in our portfolio: Rebel Foods, Nua, Bombay Shirt Company, Melorra, and Flinto.

Simply put, 2021 has been an incredible year for D2C BPC companies in the country. Q12021 recorded $109MM raised in funding, already surpassing all of 2020’s funding which stood at $104MM. Interestingly, when you go deeper into this data, the funding is skewed in the favor of Cosmetic brands compared to Personal Care ones. Across all rounds Nykaa, Purplle, and Sugar have collectively raised $280MM when compared to the $48MM raised by MamaEarth, Plum, and Juicy Chemistry. We believe Personal Care is just getting started. The coming few years will be marked by the Personal Care brands scaling up and becoming giants in the space. Companies in the BPC space also command a multiple of 5-7x, higher than other D2C categories.

|

|

Category |

Stage |

Investors |

Revenue FY20 (Current ARR) |

Valuation (INR Cr) |

|

Mamaearth |

Personal Care |

Series B |

Fireside, Sequoia, Stellaris |

112 Crore (750 Crore) |

730 |

|

Plum |

Personal Care |

Series B |

Faering Capital, Unilever Ventures |

53 Crore |

510 |

|

Juicy Chemistry |

Personal Care |

Series A |

Verlivest |

6 crore (40 Crore) |

195 |

|

MCaffeine |

Personal Care |

Series A |

Amicus Capital and RPSG Ventures |

40 crore |

N/A |

|

Mosaic Wellness |

Personal Care |

Series A |

Matrix Partners, Sequoia and Elevation Capital |

N/A |

N/A |

|

Nykaa |

Beauty |

Pre-IPO |

Steadview, TPG and Fidelity |

1860 crore (2,600 crore) |

9,000 |

|

Sugar |

Beauty |

Series C |

A91, India Quotient, Elevation |

105 crore (195 crore) |

750 |

|

Purplle |

Beauty |

Series C |

Goldman Sachs, Verlinvest, Sequoia |

94 crore |

2,250 |

VC Investments in the Indian BPC space

Exits in this space primarily happen through 2 ways: you either get acquired by a legacy brand like an HUL (i.e M&A) or you become large enough to become a digital HUL and eventually go public (IPO). Interestingly, in the US 60% of all brands in the $80-$100MM range have been acquired by legacy brands. There hasn’t been much activity happening in the M&A space in India but we expect a lot more consolidation to happen in the next 2-3 years. If not a complete acquisition, like Marico acquiring Beardo for $46MM, sometimes larger brands passively invest in possible acquisitions. Examples- Colgate invested (24% stake) in the Bombay Shaving company and Emami invested (30% stake) in The Man Company.

Exits in this space come through M&As or IPOs

If you’re a founder building something fascinating in this sector, especially in any of the above whitespaces, or just someone who wants to chat about the space and the companies, we’d love to talk. Drop us an email at research@lightbox.vc