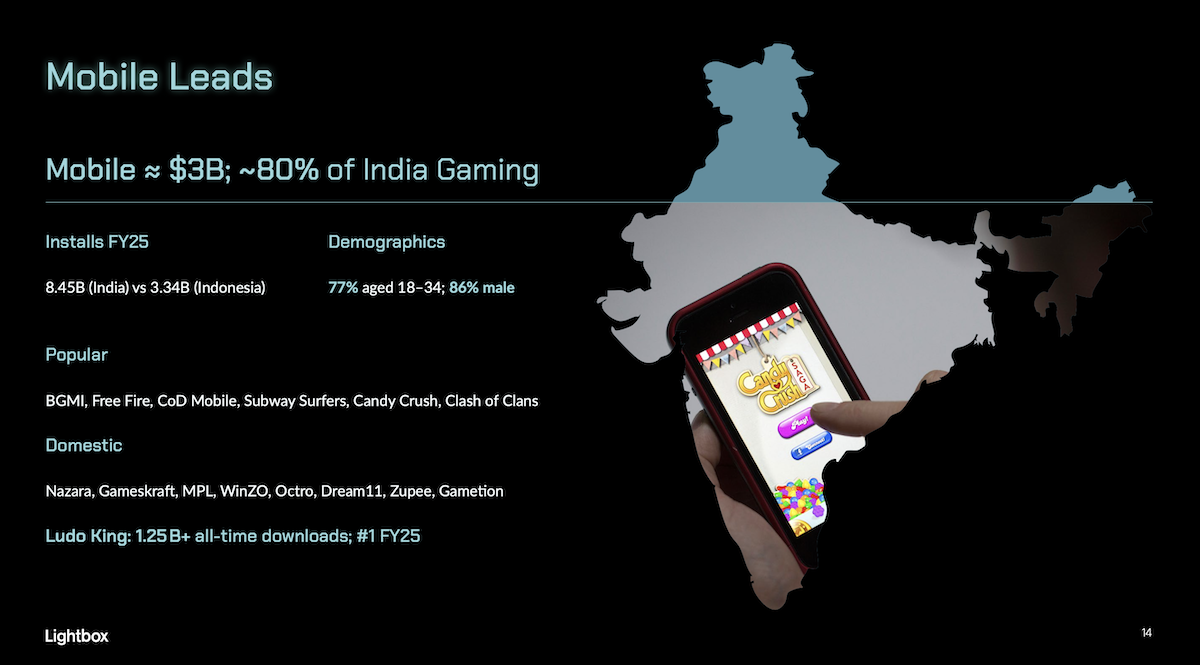

India’s gaming story is unfolding now. With over 600 million players, it’s one of the world’s largest markets. Yet India is a paradox among the highest in downloads but trailing in monetization. That paradox has also become its greatest potential, powered by a young, aspirational player base that is engaging more deeply, spending more widely, and making gaming a cultural mainstay.

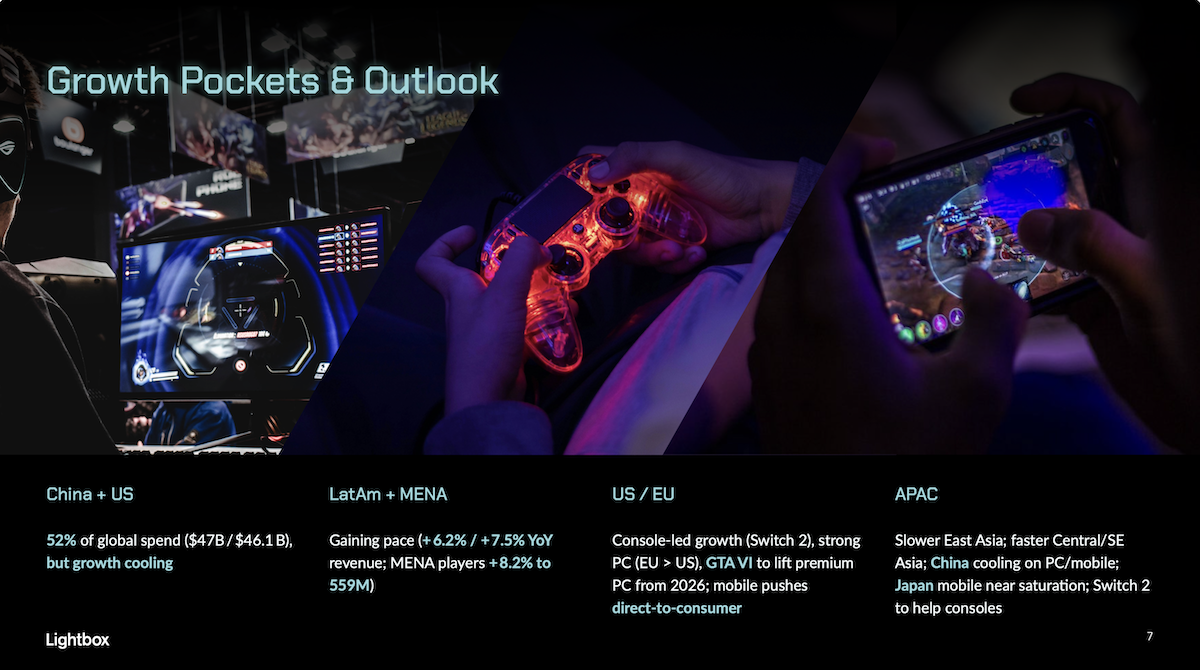

Gaming is at a pivotal juncture globally. Once a niche sub-culture, it’s now a $178billion-plus colossus that has outpaced movies and music combined in annual revenue. But as growth stabilises in mature markets, new momentum is building in high-volume, under-monetised geographies. India, home to the world’s second largest gamer base at nearly 500 million, India presents an outsized, under monetised opportunity for all stakeholders.

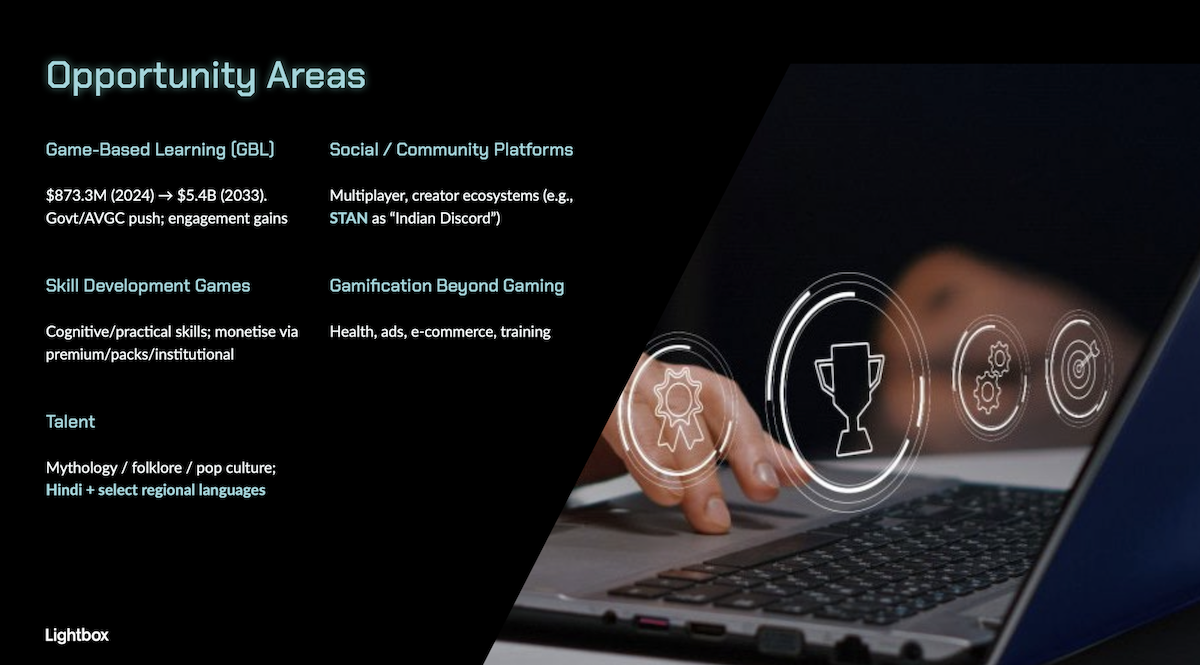

With India’s government moving to enact the Promotion and Regulation of Online Gaming Act, 2025, and ban real-money games (RMG), the regulatory risk around RMG has crystallised while non-real money games (non-RMG) including esports, social and casual games now enjoys clear tailwinds and legitimacy. The signal to gaming companies, local and global, and investors is to redeploy talent and capital towards domestically-produced IP, live-ops, adtech and alternative payments that monetise India’s vast, price-sensitive user base via micro-transactions, subscriptions and in-game ads. The combination of policy clarity and scale gives India a credible shot at becoming a non-RMG powerhouse.

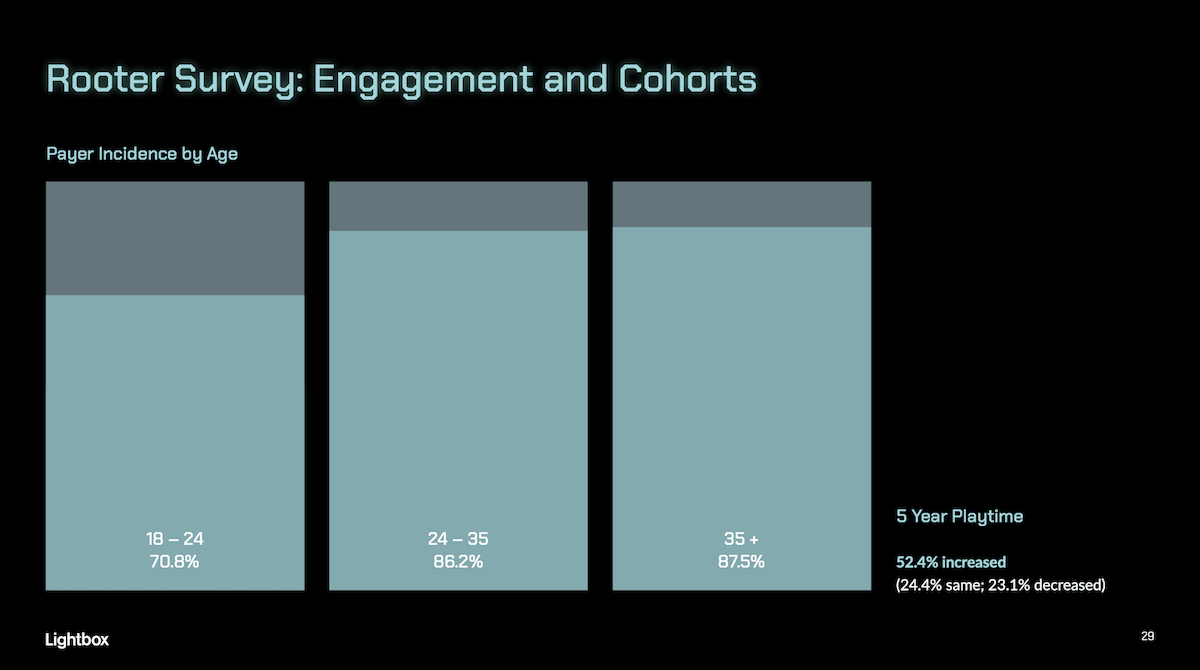

This report explores the contours of the non-RMG opportunity, drawing on global market data and industry analysis to unpack India’s unique position: young, multilingual and mobile-native, but still early in its monetisation arc. Additionally, the report is informed by primary insights from a survey conducted by Rooter, India’s biggest game streaming and commerce platform. The survey data shows a user base that plays daily, prefers regional content, and engages deeply with games. The report argues that while RMG may have powered India’s gaming boom until now, it is non-RMG that will power India’s bid to emerge as one of the world’s most important gaming markets. From the rise of local studios and live-service games to the integration of AI and cloud infrastructure, the building blocks are falling into place. India is on the brink of a new era – one defined not by betting apps or cash contests, but by the creation of durable, culturally resonant, and monetisable gaming experiences.

1. Game on: The State of the Global Gaming Market

2. India Rising: The Mobile-First Gaming Nation

3. Inside: The Non-RMG Opportunity

4. Rooter User Survery: Young Mobile Users Already Paying