India’s new-age consumer brands today stand at an inflection point. Having emerged as a formidable force in less than a decade, new-age consumer brands are uniquely positioned to influence mainstream retail markets and create value for investors. Will the upcoming decade belong to new-age consumer brands? Watch the video for more.

About 12 months ago, Nua, born as a quintessential direct-to-consumer brand, became the latest company from the Lightbox portfolio to embrace an omnichannel playbook. The company’s feminine hygiene and wellness products are now available on shelves at Reliance Retail, Dmart and Lulu Mall among others. Nua’s omnichannel play is reflective of a broader market shift where new-age consumer brands that set out to disrupt organised retail with their online-first, direct-to-consumer (D2C) approach are evolving their business models in response to changing market dynamics.

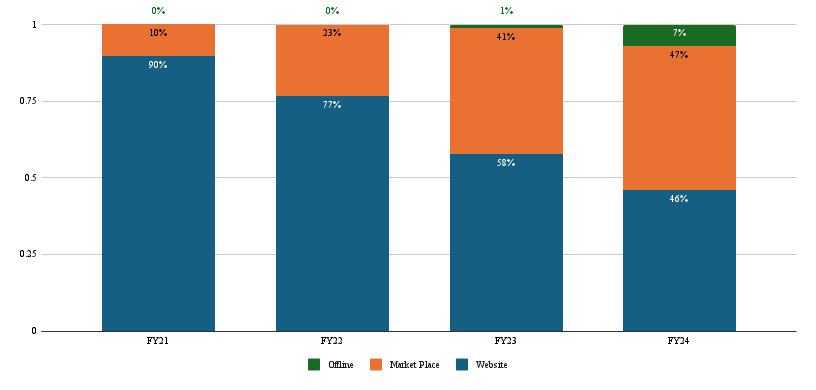

Nua Online-Offline Revenue Mix

Within the Lightbox portfolio, early adopters of the omnichannel playbook include Furlenco, Bombay Shirt Company, Zeno Health and Amaha. As emerging consumer brands that cater to India’s largely unorganised consumer markets, a multi-channel approach has been invaluable in enabling them to most effectively serve their target customers.

Amaha Online-Offline Revenue Mix

India’s new-age consumer brands today stand at an inflection point. It's estimated that by 2030, consumer spending will constitute 67% of the GDP, aided by a 5X growth in middle consumption and rapid smartphone and internet penetration. Consumer behaviour is increasingly shifting towards greater convenience and personalisation, factors that are addressed more effectively by new-age consumer brands than incumbents. Having emerged as a formidable force in less than a decade, new-age consumer brands are uniquely positioned to influence mainstream retail markets and create exponential value for investors.

Will the upcoming decade belong to new-age consumer brands? As omnichannel emerges as the dominant go-to-market strategy for many of these brands, what will they have to do to overcome the significant challenges along the way? How is the D2C playbook being rewritten in response to changing market dynamics? We recently put together a stellar panel of experts from the consumer sector to find answers to some of these questions.

Kedaara Capital managing director Anant Gupta shared his learnings from investing in companies such as Manyavar and Lenskart as well as building a personal care business at ITC. Naiyya Saggi, co-founder of the Good Glamm Group, brought in the operator perspective on building and scaling an online-and-community first consumer business. Abheek Singhi, managing director and senior partner at Boston Consulting Group, provided deep market insights into how the consumer markets are evolving. Finally, former Marico veteran Chaitanya Deshpande brought in much-needed insights from the world of traditional FMCG. The session was moderated by Lightbox managing director Sandeep Murthy.

Watch the video for the full session – The D2C Decade: Opportunities, Challenges and Playbooks. Below is a transcript of the session.

(Transcript has been edited for readability)

[Sandeep Murthy] Thank you everyone for coming. I think this is the start of many more sessions like this that we want to do. Let's just jump right into it and bring up the starting point. We wrote down this topic – The D2C Decade. And we said, alright, let's talk about D2C and let's see what it is. And then the question came up right at the beginning -- what is D2C? Abheek (Singhi) maybe we'll start with you and your thoughts on it.

[Abheek Singhi] There are probably 2-3 alternate definitions for D2C. One, brands that are online-first. Second, when you are selling to the consumer directly. By that definition, all integrated retailers will also become D2C. Third, can we find a compromise between the two? My personal view is that D2C is a brand or a company which captures a significant part of the value and in many situations that means that you have to be involved in more than just brand creation and also play an active role in some part of the retail and distribution.

[Sandeep Murthy] Anant (Gupta), you added the point on valuation. You put the word D2C and suddenly you get a different multiple?

[Anant Gupta] I do feel that D2C is just a fancy way to get a higher valuation multiple. But, as Abheek said, D2C is nothing but direct-to-consumer. It's not a new term. If you think about every retailer in the country who sells directly to the consumer, it's direct to the consumer. So sometimes what gets confused as the new D2C is actually just online-first brands. We've invested in a few so-called D2C or retail brands like Manyavar, Lenskart, Vishal Retail. We sell Rs 9,000 crore worth of products directly to the consumer. So those have been in existence for the longest time.

To my mind, the power of D2C -- and I'm using broader D2C because that's what is relevant and not just online -- is consumer-first. It is the ability to collect a lot of inputs from the consumer and build a lot of those inputs back into the feedback to the consumer. The beauty of D2C brands is that you're so close to the consumer that you can convert a consumer obsession into what is important for the consumer and D2C brands let you achieve that.

[Sandeep Murthy] Naiyya (Saggi), when you think about the world and you look at how you approach customers, or how you think about customers... let me put it differently. Do you get bothered with certain companies being considered D2C when they're not, or certain people trying to inch their way into that world and claim that they are D2C. Or do you believe that everybody and anybody who's collecting data or anybody who understands, deserves to be in that category?

[Naiyya Saggi] So, I mean, I don't get bothered. There's enough in life to bother about. But, I think the bigger question is: why is this narrative even so important today? And the narrative is important because it points to an underlying and widespread phenomenon, which is, in my opinion, that of insurgent brands. What do we mean by insurgent brands? In my head, it takes on the manifestation of anything that's out to start from questioning the status quo.

The status quo could be fragmented, large markets not being served by any brand. Or if there are two or three legacy players, or one large legacy player, a brand comes in to challenge that status quo. That is interesting. Or number three, there's a product innovation that a new brand brings to market, challenges the status quo on how a product has typically been experienced or used or price positioned with customer bases. The fourth, of course, is also the channels in which it operates. Large legacy brands typically operate from the same distributor, retailer construct and paradigm. Asian Paints in its time was considered an insurgent brand in many ways.

So I think, if I take a step back, this D2C piece is a microcosm of a broader construct and trend we've seen play out, which is the trend of insurgent brands. And I think that's where we go back and say, do these brands have a right to win in the market? And I think if they address any of these four paradigms, then there is a very important right to win for many of them. D2C is one channel, is my take.

[Sandeep Murthy] Then what you’re saying is that it's about the brand and less about the channel. The channel happens to be one of the pieces to the brand.

[Chaitanya Deshpande] I think the definition is critical. So when you say D2C, it should actually be directly reaching the consumer and not just selling online. Because the real advantage is being able to get that quick feedback from the consumer and then you decide what you need to do for the product, make changes, personalization and customization. Because that's critical for the insurgent brands. Otherwise, if you end up selling a mass product, it's going to be extremely difficult to battle the incumbents on that because they've got scale. Just the gross margin on the product, you will not be able to match them. You won't be able to match them offline in terms of the kinds of margins that you have to give retailers and distributors. So the only advantage you have is really being able to identify a specific consumer.

[Sandeep Murthy] Let's talk about that a little bit. The moat that traditional retail had for a while was distribution. They aggregated this disparate retail channel, figured out how to drive products through it, and understood how to sell. But they didn't necessarily have that direct feedback. We still live in a world that's largely fragmented. We're getting organised in pockets online, offline in different ways. Do you think that that moat of distribution is still valuable?

[Chaitanya Deshpande] I think it is to some extent because when you're looking at D2C, first of all, if you have a small base, there's a certain cost of reaching those consumers. There's a certain cost of servicing that customer also. And therefore there's a certain pricing that you will have to use for your product. So how do you make margin and how do you make money? Therefore you are going to end up servicing only a certain portion of the population. Like we were saying earlier, in Marico, we used to joke that we can't come up with some products that serve only Colaba to Bandra West. It has to go to other parts of the country as well. But now, yes, there are monies available with consumers in other parts of the country. Abheek (Singhi) was telling us, what 16% of households have above...

[Sandeep Murthy] I think you’ve got to give that data.

[Abheek Singhi] One thing on which I have a slightly different point of view... just to make (the discussion) interesting... I think what was different was that the channel was not a moat. Because actually, if you look at the Indian distribution system, the wholesaler-retailer margin, and the way it gets to the end consumer, I would argue it is the most efficient in the world. There is nowhere in the world that you can get an FMCG product at those kinds of price points with somewhere between 10% plus 6% kind of margins. Can't happen anywhere.

[Sandeep Murthy] Can you talk about why? Why does that happen? What works so well here?

[Abheek Singhi] I think it's partly the unorganised nature and extremely frugal cost structure of the retailer and the distributor. And, there are a large number of Indians for whom even that income is a good enough income. So one of the things which many companies say is that distribution is no longer an attractive business. The next generation of the distributor doesn't want to do distribution. That is true, but the fact is also that for every distributor who is walking away, there are 20 eager guys who are saying, I'm happy with that. So I think the advantage that a Marico, HUL or ITC have is that you will have that in a district. In snacks, for example, you will have literally 1000 brands across the country.

The challenge is the scale-up. And I think that's the capability which D2C, at least in the top cities allows you to do because you have the platform available now.

Most of us, the poorest person that we will know, the household family income is probably going to be somewhere around Rs 3.5-4 lakh per year. At Rs 4 lakh per year, that's top 20% of India. So, you know, there is a vast 80% of India... When we talk about D2C, we're talking about that 20%. And that 20%, 16% actually has a lot of buying power. And to the point that Chaitanya (Deshpande) was saying, maybe 20 years back, the purchasing power of that 20% between Colaba and Bandra West was not large enough. Today, actually, that's large enough.

And therefore, I think, the discussion we were having was to say, you know, if you look at the runway, is 16% or 20% of India good enough for growth. And actually, it is, as a starting point. Second, what's happening is that this number was probably 10% of India 10 years back, it has now become 16%. In the next five years, it's probably going to become 20% or 22%, or whatever that number is, and you're talking about 70-80 million households who actually are able to afford (from the 30-40 million households today), and that's that's enough scale.

[Anant Gupta] Is distribution a moat? As an investor, I feel it's a very strong moat. Now, it's not a moat when you're a Marico or an ITC or a HUL because you all have the same distribution. But if you are a business, like all of your businesses, your ability to reach that distributor will definitely become a moat because the others don't have it. That's the first thing. So at least, don't take it that distribution now no matter what matters because it's available to everyone. It is not.

One of the other things we were debating, a lot of online businesses, when they start online, they can reach the consumer very quickly and they feel offline business is very easy to crack like the way they scaled online. It's not. Because in an online business there are only two stakeholders, you and your customer. You sell a good product, good positioning, good pricing and the customer buys it. The moment you get into retail, distribution and general trade, that's not the story. Now, it doesn't just matter that you have good pricing, good distribution. Is the distributor happy with you? Are you giving enough margin? Are you giving enough credit? What's your stocking policy? What's your servicing level? Is the retailer happy or not? Is your distributor servicing your retailer? Suddenly now you're getting engaged with 100 distributors and lakhs of retailers and everyone has his own ego. You should try, I'm sure a lot of you have, but if not, try going and selling to 40 retailers and you won't even get time. When you go as a customer versus when you go with a product in your hand. It's day and night.

I actually started my career with ITC. And I was part of a small team which was building the personal care business and part of our work was actually to go and sell. Us going as ITC in a retail chain, literally we had to beg and plead, please keep our product. So it's very different when it comes to general trade. So it is definitely a big moat.

I think the big competitive edge for a lot of D2C businesses is that the larger organisations like HUL, ITC will never innovate. Because for them the cost of failing is very high. Look at soap as a category. Look at HUL, look at ITC, look at Godrej. They will have the same santoor soap, the red soap, the yellow soap and the green soap. And the best innovation they will do is that this has menthol and the ingredient would say .0001%. That's all the innovation we'll get in soap. But the beauty of a D2C business is they understand what the consumers really want because they have that data. They have that risk appetite. So the actual category creators could be some of these D2C brands.

And you know, I'll take an example of Whole Truth, which is fantastic... he's come up with a very simple thing. Three ingredients, nothing else. What I say is what it is. No false claims. It's true and honest. And when you meet Shashank, he will tell you, I'll shut down the business but I'll never sell anything which is lying to the consumer. That's the position. No one will ever get you that positioning. Maybe it's not a large market. But listen, you don't need to create a Rs 10,000 crore business. Find your consumers who can actually help you build a Rs 1,000 crore business, that's great. That's a great brand, you have a strong positioning, no one can compete with you on that positioning. And to my mind, that's the power of D2C.

[Naiyya Saggi] So I'll tell you what we're doing as a group as well right at Good Glamm. If you read most DRHPs, they basically list marketplace as one of the biggest risk factors. The dependency on marketplaces, 80%, 90% dependencies in most cases and the reason for that is, while of course setting up offline requires a whole different DNA and an understanding of how the entire offline dynamics works, even in marketplaces, for the most part, the whole repeat, replenishment, retention rates is the data we don't get as brands. So to kind of take a step back, as a group, what we are seeing is an 80:20 split right. 80% online and 20% offline. And we've consciously chosen to say that every channel – D2C, which is 60% of our revenues, 20% is marketplace and 20% is offline -- these are three different channels. And I think to have that understanding itself, as entrepreneurs and operators…

If you look at the more than 1.5 million or transactions monthly that we do on our own platform, a very substantial portion of them, about 40 to 50% of them actually come from repeat customers. So there are two pieces to this. One is when you own the customer, and you truly, truly own the customer, there's a lot of marketing automation, CRM journeys, customer insighting, etc. you can do to cross-sell, upsell, repeats, encourage replenishments of products, which makes you much more efficient on a pure play D2C channel than you would any other channel out there. Because that customer insight you own, and the customer reach-out as well in a very hyper-personalised way you can do.

The second thing that I think has worked for us as well is that we are now a multi-brand player, if you really think about it in some sense. So earlier, if you were selling cosmetics, colour cosmetics to a particular individual… Today, you can kind of look at the persona, because we have that customer data. And you can see, is she also someone who we could sell a Moms Co product to? Or could we sell a Sirona hygiene product. So again, you improve that basket.

So I mean, where are we going with this? We've talked ad nauseam as an industry about the 30 million odd customers in India. I think our big mandate is that before you go into a different way of pricing or distribution innovation, or product innovation, which serves the next wave of customers, in this 30 million itself, can you figure out a way to make your reach out, customer acquisition and your LTV most efficient?

[Anant Gupta] I will talk as an investor. I don't like these 30 million people. I like the next 500 million. The 30 million people are extremely finicky. They have a lot of options. I like businesses which actually cater to the rest of the 500 million. We've invested in all of those. Vishal Retail, Lenskart, Manyavar, Purplle. The market is so large and no one is catering to them. No one is addressing (those segments). All the D2C companies talk about premiumization. India is all about volumes. Look at the businesses we've invested in. They're going to be the largest consumer businesses in India. Lenskart is now doing Rs 3,500 crores roughly in revenues. Vishal Retail is Rs 8,000 crore-plus. We sell our own brands only.

[Sandeep Murthy] If I'm competing for that customer at that price point, that customer is very price conscious. I'm not saying price equates to value. To service that customer with a cost structure that works. Would you argue that that's where the innovation is taking place?

[Anant Gupta] Innovation doesn't have to be just product innovation. It can be supply chain innovation. It can be manufacturing innovation. It's not just about putting out the most creative product. It’s about creating a creative product or a good product which has aspirational appeal at an attractive price point. It doesn’t have to be cheap.

[Abheek Singhi] Vishal, as an example, right? Actually, I would say, Vishal is the H&M of India. It's at that affordable price point, from an India price point perspective. And it has probably got full price sell-throughs equivalent to the best in the world. And I'm sure it has not come easy. But the place where I would also differ is, depending on the category, there is enough money on the premium side as well. Take Apple India, for instance, which is bigger than Hindustan Unilever. Apple India last year, FY23, reported revenues at more than Rs 50,000 crores. They have reported 40% growth. So, we are talking about, you know, somewhere around Rs 70,000-80,000 crores topline, products sold in India. And this is a 10-year phenomenon for Apple.

[Sandeep Murthy] This is without a retail footprint. Without a direct distribution footprint. Everything we're saying, as a D2C business, to build a brand and create your presence... we're saying you need to have direct, you need to have that feedback, you need to have the relationship…

[Abheek Singhi] The only thing I think is different is, if you look at Nike or Apple, they are such strong brands that even though they are on marketplaces, they are on marketplaces on their own terms. That's an important distinction. You will never find an iPhone on an un-thought discount compared to some of the other brands. But to your point, where I would differ is, there is a good enough market at 30 million and a good enough market at 500 million. The challenge which ends up happening is when people try to play both with the same model. That is a disaster.

[Naiyya Saggi] I just want to build on that. Absolutely. The biggest problem with brands is when you try to be everything to everybody. That's when you lose the plot. All of us as operators work with a certain finite resourcing. In terms of where we want to go every year-on-year, quarter-on-quarter, there's a certain target we set for ourselves. The biggest learning for me has been how to make the customer cohorts we're already tapped into super efficient. Because that's where you can actually see an S-curve come into your margins and into your revenue structure.

[Sandeep Murthy] Chaitanya (Deshpande), I want to talk about a large FMCG company and product launches. Because we're talking about selling more products to the customers we already have. How often do product launches happen? How successful are they in saying that, I've got a customer buying Parachute Oil and I'm going to sell them the next product and capture wallet share. I do see this as an ideology that exists. Take Veeba, for instance, Veeba started with sauces... and every time we have a packaged food business come in, the segment there is just the start. And they agree that it's not going to happen there. They have to expand. That seems complicated. And that seems hard. Because, again, you go back to points of innovation and differentiation, it has to come from the supply chain. You were giving examples before of grammage in the packaging. And you're thinking about that universe to now say, if I sell oil, I'll sell soap and this and that. Was that the philosophy? Was that the mindset?

[Chaitanya Deshpande] To some extent, yes. So if you look at the traditional players, the pace at which they launched new products was far, far slower than the new companies that are being introduced. Largely because again, their mechanism for feedback was not the same. You didn't have the advantage of data coming in through D2C. You can’t quickly make some changes and send out products all over the country on a huge scale.

[Sandeep Murthy] What's the value then of launching something just because... you have to have a logic behind saying that my product is better. Otherwise… what gives me the right to actually win in that segment? I mean, just because you can doesn't mean you should and you've got decades, if not centuries of perspective to say that it's challenging.

[Chaitanya Deshpande] Typically, even if you look at Marico today, if it thinks of launching a new product, the time frame can be anything from... six months will be really fast. Typically, it takes 18 months for them to go through the entire process. You'll still probably go and meet consumers physically and gain insights. And then you will test launch in one market and go to one state, prototype, those metrics need to be met. And then you go to other parts of the country. So the pace at which they'll do it is far, far slower. But then you're more sure about the product succeeding. Because when you launch, you'll launch at a large, large scale.

Also, again, when you go back to do a few years, if you launch a product, there's a cost that needs to be incurred in that product launch. Because you're doing TV advertising and things like that. Any new product launch would cost Rs 40 crores. So, these companies are not willing to say that okay, I'll just casually experiment. It's going to hit that quarter's numbers and then you have to do your conference calls with the investors and explain why margins fell during that quarter.

[Sandeep Murthy] And yet you don't necessarily think that the FMCG players worry that much about this? They’re saying, okay, can you get to Rs 100 crore (revenues), Rs 200 crore, even Rs 1,000 crore.

[Anant Gupta] I think the try, fail, learn, is just very fast in the D2C business. They try, they fail, they learn, they try again. But having worked in ITC, they will do research for 20,000 people. Pink needs to be darker, lighter. The level of innovation... because the cost of failing is just very, very high. Product launches are like Rs 200 crore and at the end of it, when you bring it through all of these filters, you will realise you're going to make exactly the same product which has been in the market because you applied the same filters.

On the other hand, D2C companies can track which ingredient is selling really well in which market. A certain ingredient may deliver a benefit in the state of Karnataka but people in UP may feel that the same benefit is delivered by another ingredient. Now, a large company like ITC or Unilever will say okay, listen, I can only launch one product. Whereas, as a D2C company, I can customise the product for UP and launch a similar product in Karnataka.

The reason FMCG will not be worried about D2C brands is because they know that you are catering to that 30 million while they are catering to the 700 million.

[Abheek Singhi] Actually, I think, the reason it doesn't happen… maybe, maybe, some consultant put in a stage gate. At that point of time it made a lot of sense. But actually, now it doesn't. Second, it’s also driven by internal factors. In a small company, you (the founder) will decide, let's do it. In a large company, the category head will need to have a conversation with a factory head. The sales guy will say, I'm already trying to push six new products, you're giving me the seventh one… some of those dynamics come into play. In a smaller D2C, there's one person who will say, hey! let's just do it.

[Naiyya Saggi] It’s a very important point… about the cost of failure. The monetary cost of failure. The reputational cost of failure. Think about it. It costs anywhere between Rs 40 crore and Rs 200 crore to launch a product. Today, most insurgent brands, direct to consumer brands, have heavily invested in their communities, in their social assets and their content assets. For us, for instance, when we launch a particular product, what do we do? We put it on PopXO, Miss Malini, Baby Chakra and go out and talk about it. We put it up on the socials on our brands, we have partnerships with a bunch of amazing celebrities and put it up on their social handles as well. We have large communities. So in one go, on that same day, you're basically reaching 150 million MAUs. At least they are informed about the product launch. And this is pretty much truly at zero cost to us. Of course, there’s the cost of the team.But it’s basically zero marketing cost.

[Sandeep Murthy] So that’s your distribution. You’ve replaced the moat of distribution with the ability to create awareness.

[Naiyya Saggi] Correct. And, the other interesting thing is that these are three distinct channels. The revenues come directly from our own commerce, ecommerce sites and our own ecommerce apps. This top-of-the-funnel actually feeds directly into our product and into our conversion journeys. It's not that I have to send them to marketplaces, where as we know, marketplaces are also walled gardens. So I think the more you kind of remove the friction… and of course, we all know this as entrepreneurs ourselves, Google ad costs, TV advertising, etc. is not getting cheaper. So, the more you own the customer, the more you own the communication, the more you can convert them.

[Sandeep Murthy] I want to change gears for a second. A large part of what people compare to is other markets. Earlier we were talking about the Thrasio model which again comes from another market and we tried to understand what that means here. But let’s just stick to D2C for a second. And, we saw the growth of all these brands in the US. One thought I had was that the lack of incumbency here enables a very different approach to how to look at this stuff. So while you have Marico, while you have Hindustan Unilever, while you have Godrej… their penetration is at a certain level and the penetration across categories is at a certain level. So the ability to come in and do something interesting, you're competing perhaps with a more fragmented base, both from a distribution standpoint as well as from a penetration brand standpoint. And so therefore, the failures, and they literally are the failures in other markets whether you look at Bonobos, Casper, The Honest Company… so now, do we agree that the dynamics of this market mean that the playbook can look different and the opportunities look different? Or are we just hoping for something that's unlikely to happen?

[Naiyya Saggi] Why aren’t you talking about the successes? There’s Fenty, there’s…

[Sandeep Murthy] Sure and are they successful because they are in segments that don't have such great incumbency… and does that mean that here, because of the lack of penetration across categories, the opportunity exists to build in many more.

[Naiyya Saggi] We can talk about each of the examples and I’m sure everyone has a perspective. But I think the reality is that when these companies were doing well, they brought in a very differentiated product offering and and go-to-market strategy. When Jessica Alba launched The Honest Company, the whole premise of being SLS-free, we’re truly transparent about ingredients, etc. and then, of course, the lawsuits that came later… when you start from a place of trust, your name is Honest Company, if you go a certain way, it's difficult to recuperate from that. But if you look at Fenty, for instance, right? Very strong positioning on the inclusiveness of its product offering, of its colour shading, etc. And coupled with the LVMH partnership… it’s a $1.5 billion company in less than four years. So, I think it totally depends, again, on do you own the distribution? Or do you have eyes on a distribution? And do you have a unique insight into the market that you can take to scale? I think these two things are the big pieces that really worked for these brands.

[Anant Gupta] The way I think about this is, what is your customer proposition? If you have a very strong customer proposition, then there is no reason for you to de-grow. Now, there are a few reasons why you would have de-grown. One, because the quality of sales that you were getting earlier, the quality of revenue… I think a lot of people focus on revenue and not the quality of revenue. I think in the last four years, there was more focus on valuation rather than building really good quality businesses which were customer focused. And what has happened is that as the discounts have gone, the quality of revenue has come to what is actually the quality of revenue for that business.

Second, I think, when there was a lot of money available, a lot of people were trying to do different things. And the good part about the funding winter is that it makes you realise your real core, your real product and focus on that. So sometimes, you know, this revenue dropping is actually that revenue was never there. It was just artificially inflated. And to that extent, I feel that when you're building a business, you don't need to grow 100%, 200%... there were times in 2019-20, some companies came to us – this was a real company – who came and said I want to become a unicorn. They got some venture capital fund to pay them a billion dollar valuation, they became a unicorn, the revenue of the business is still the same as it was three years back. It went up and it came down. It was never supposed to go up.

So, to my mind, I think, build a business which is solving a consumer need, build an aspirational brand. None of you guys are doing this for 3-4 years. If the idea is to quickly flip it, sell it, that’s fine. But if the idea is to build a good, solid business for the long term, let it grow at the normal pace it should grow. Obviously, the more time you spend on the product, on the pricing, on the aspiration or the positioning, you don’t need to worry about whether it’s growing at 20% or 50%. That's an outcome.

[Abheek Singhi] I think we've talked about building brands. And, the one thing I've seen, both in large companies and in insurgent brands, is actually knowing your consumer and knowing what's happening. And honestly, I think the consumer is missing in many of these discussions. And, I think, over the last decade, probably one of the poster children as a category has been mobile phones. I came across some data which shocked me. Maybe it won't shock you. In 2013, Indians bought 250 million cell phones. In 2018, that number went to 320 million cell phones. In 2022 and 2023, guess what that number was? It’s actually 200 million. Actually, it has plateaued. The assumption is, okay, volume growth has become negative but value growth should be there. And it has. The average selling price for a cell phone was about Rs 5,000 in 2013. Last year, it was about Rs 15,000. But even if you take this annual period, the value growth for mobile phones, arguably the hottest category, is just barely 10%. So where is the consumer spending her money? And, you know, I think insurgent brands, D2C, intuitively get that much, much better than any consumer research, market research company.

[Sandeep Murthy] Since you're giving some data points, you want to also tell us about toothpaste, FMCG, what you saw there?

[Abheek Singhi] So, in November, I made a presentation to FMCG CEOs and I was surprised, and I triple checked the data. If you look at the last 15 years, FMCG volume growth in India has been 3.4% of GDP and consumption has grown at 6%, over a 15-year time period. Value growth has been 10%, slightly less than 10%. Nominal GDP growth has been about 12.5%, 13%. Now, what's happening is, if you unpeel this and now we’ve got this consumption survey data also, essentially people are moving away from some products to other products and services. Health and education services in this time period have grown at 12% nominal. Products, as a whole, have grown at 8% nominal. So, and of course, the average, the top 10 cities, the X, being different and that's a piece which, I think, the D2C and insurgent brands really are able to identify. You know, there is a need for ingredient X, format Y and they're able to cater to that. And I think that's what's really going to make a huge difference in terms of driving this kind of growth.

[Sandeep Murthy] It just surprised me as we were talking about that. People just assume that India is growing, everything's growing, FMCG is growing, life is beautiful. And I think when you look at that statement, you say, wait a second, I don't know anything. And combined with your point earlier about the fact that the poorest person you know is 20% of the overall… really means that we don't have an understanding of where we’re going. Which probably brings us back to the fact that the target markets that we’re going after end up being there…

[Naiyya Saggi] There’s so much complexity building in India. I love the point, which is, when you’re building brands in India, I think all of us are committing to a 25-30 year horizon. And I think these milestones… a lot of reports out there on what the top 150 brands out there have done, etc. what they should be, what they shouldn’t be, how much should CAC be, etc… but eventually, the biggest flexibility at some level we have as operators is that we're not subject to this quarterly scrutiny that these large companies are subject to and you can actually grow. And we're also hopeful that investors today are a little more patient probably than they were in the early years of D2C investing.

[Sandeep Murthy] I was trying to think of an effective way to summarise the discussion. And I don't know how. I think the reality is, I'm somewhat heartened by the nature of our discussion to say that I get very worried when there’s hype. And excessive hype has existed around this word D2C. And ‘insurgent brands’ is nice, but there will be hype now around that as well. And so, at least if we look at this and say, listen, there are clear opportunities to create value for customers. Those are being addressed by interesting people building interesting businesses. If you do the right sort of things, something good will happen. And that system I take some hope in and say that if we can keep finding opportunities like that, and keep building businesses like that, I think value will be created moving forward.

I think you've (Abheek Singhi) confused me on the market. That's a separate conversation. But I do think that lens has to come in to really understand who we're talking to, why we're talking to them, what is real, what is not real… But like I told you guys, at the beginning, this conversation was largely set up for my personal enjoyment. And I really did learn a lot. I'm glad you guys all joined in as well. I hope you got something out of it. But thank you very much for taking the time to do this. I hope you'll hang out for a little bit because I think there's a lot more conversation to be had. And I want to make sure everyone has a chance to just chat. But thank you so much for doing this. And hopefully, we'll come back to this topic again in a couple of months or later in the year and see what was played out and how it's gone.

(End of transcript)