The increasing prevalence of chronic diseases, stronger digital health penetration accelerated by the pandemic and early behavioral changes observed amongst the Indian consumer piqued our interest into the space. It goes without saying that we deeply care about spaces where large problems need to be addressed and strongly appreciate companies solving for these numerous problems.

How many of you reading this article have a diabetic member in your family? Probably most.

How often, over a dinner, have you observed somebody skipping dessert to avoid a glucose spike? Often enough.

Is it fair to say, forcibly or not, that you know enough people that exercise solely for the purpose of managing their chronic disease? Yes, but their diligence is questionable.

.png)

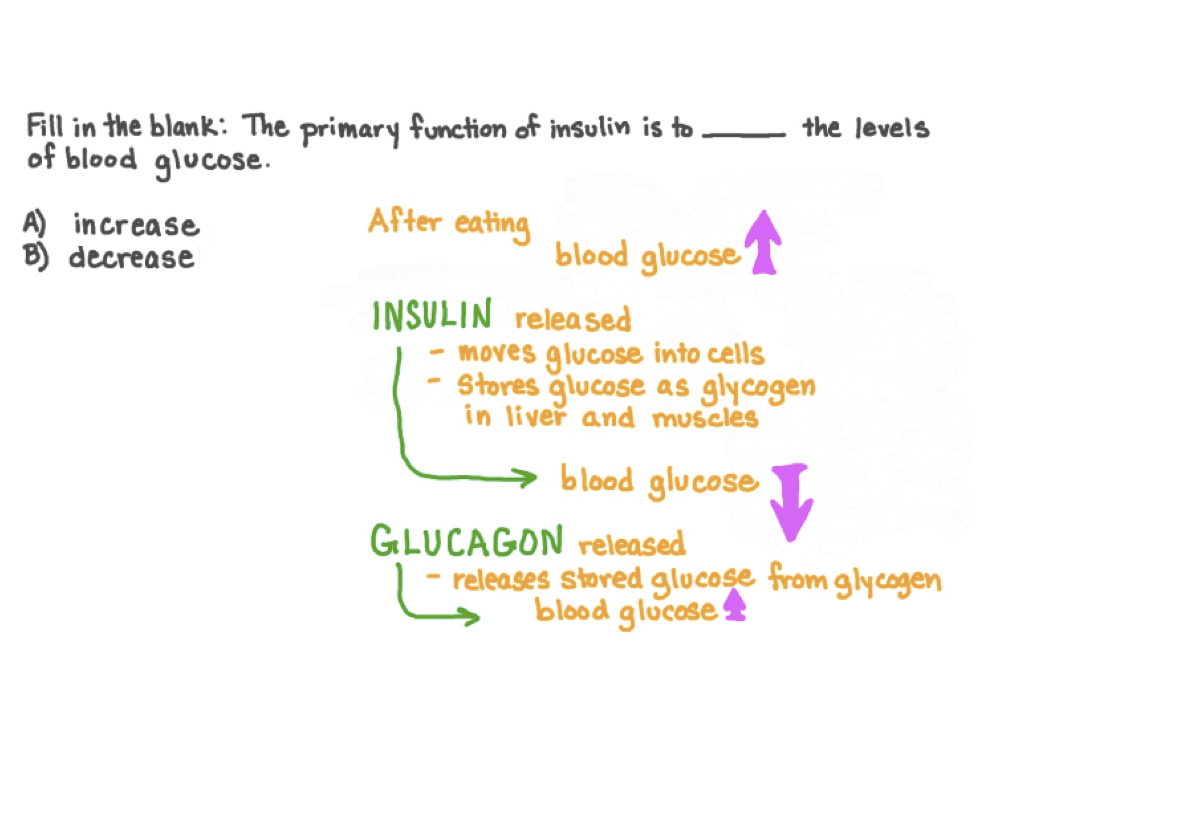

Interaction of food intake, insulin activity (lack thereof), organs and cells

The reason we know the answers to these questions lies in the unparalleled prevalence of diabetes in India. The answers above also throw some light on Indian consumer habits (but we’ll get to that in a bit).

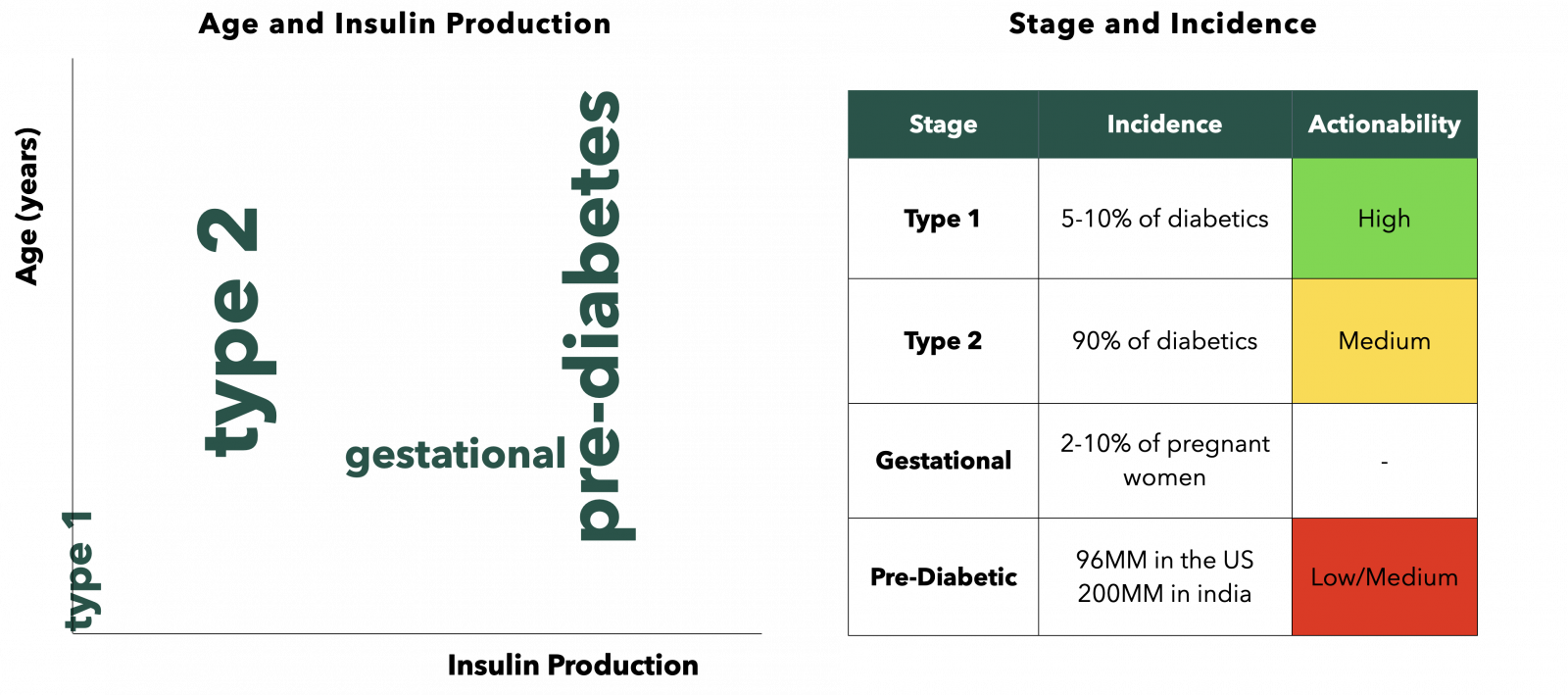

As a matter of fact, India is home to 70MM out of 482MM global diabetic patients. A staggering 200MM additional people are pre-diabetic in India, contributing to a $17BN market. A majority of the 70MM are Type 2 diabetic where the condition is lifestyle or genetically inflicted. The various kinds of diabetes, the incidence and actionability required are shown below:

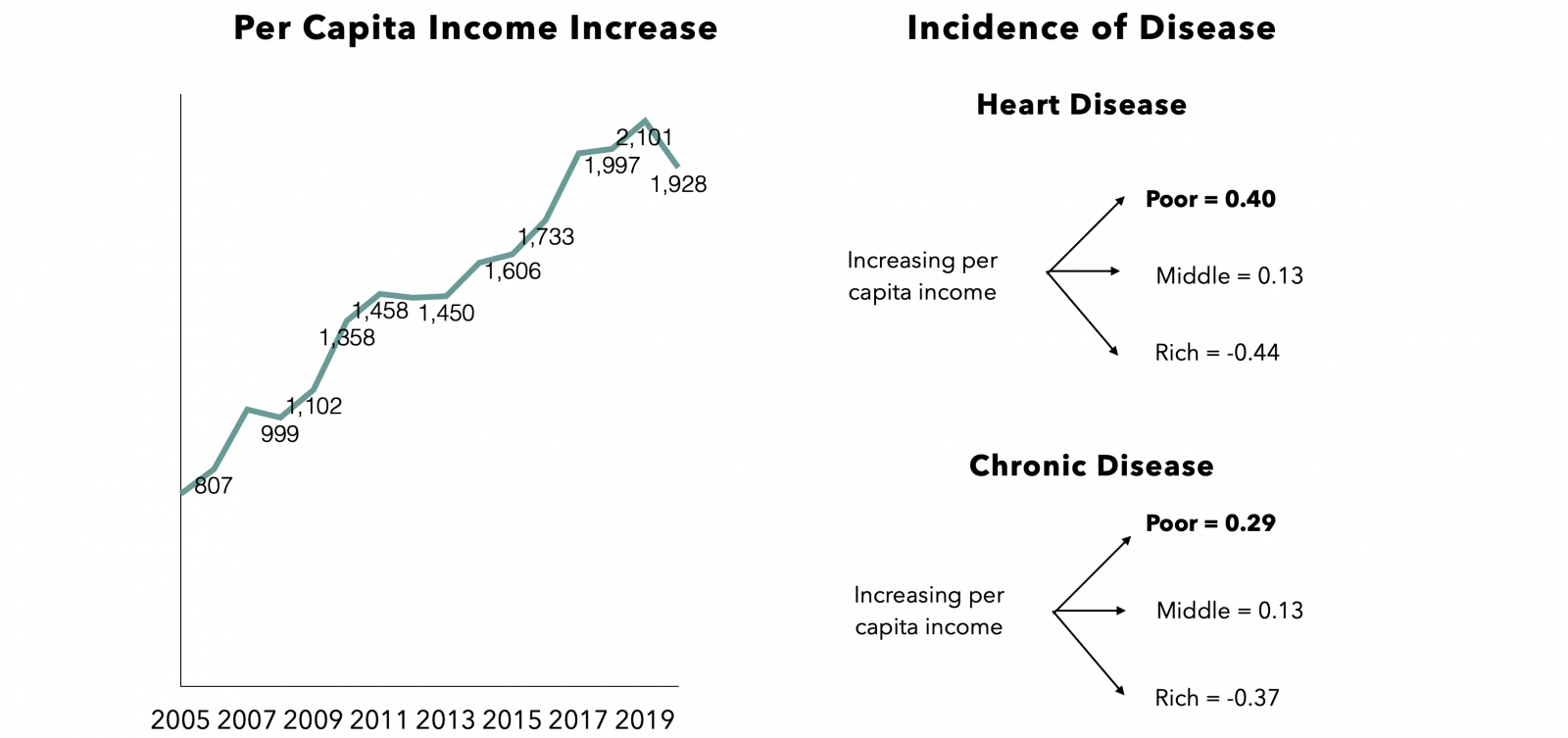

While sizing this market, it was surprising to learn that as per capita income increases in a poor/middle income country, the probability of chronic diseases like diabetes also rises. Just to break down the probability chart below, for low-income countries like India, there is a 29% probability of chronic disease incidence with rising per capita income. When you allow that to sink in, it is rather startling.

Therefore, the increasing prevalence of chronic diseases, stronger digital health penetration accelerated by the pandemic and early behavioral changes observed amongst the Indian consumer piqued our interest into the space. It goes without saying that we deeply care about spaces where large problems need to be addressed and strongly appreciate companies solving for these numerous problems. Our investments in Zeno Health, InnerHour and Nua are representative of our desire and passion for transforming healthcare and awareness in India.

While spending time researching the diabetes industry, understanding the disease, and speaking to passionate founders, we synthesized our view on diabetes management to look like this:

Now, you ought to be wondering what we mean by direct to patient versus direct to consumer. Let’s break it down: in the realm of diabetes management, direct to patient implies selling products and services to consumers with diabetes. A company may sell superior quality data and a holistic diabetes ecosystem through a Continuous Glucose Monitoring (CGM) device. The person in this scenario is singled out, very much reminding them of their condition. In direct to consumer, another company may sell superior quality data and actionable health insights through a metabolic score. In this scenario, the underlying hardware (CGM) is the same, but the TG is far more generalised without singling anyone out based on a chronic disease. As obsessed as we are with all things consumer, we have learned that the latter approach in India has traditionally been more successful. But let’s take a look at the former before jumping to the latter.

Feeding off the pandemic and India’s consequent push towards increased digital health consumption, a sizeable number of new age diabetes management upstarts are utilising various hooks to inculcate positive behavioural change and improve nationwide diabetes management. Some of these hooks include: garnering a community, providing accessibility, analysing high quality data and software as a service. Let’s deep dive into each category..

.png)

Direct to Patient

To solve for behavioural changes, you must create a community of like-minded people. At least that’s what Breathe Well Being thinks. The company has essentially created a clinically approved digital game to manage and reverse Type 2 diabetes at scale. The method includes curriculum, coaching and challenges, with a requirement of scoring >35 points to move forward into the next week of the program. We’ve seen the gamification model successfully play out with Fittr, a profitable fitness and health start-up, who managed to crack community in a fitness market 5x smaller than India’s diabetes market. Fittr identified that India requires assisted fitness with personal touch in the form of a service. They solved for low motivation and triggered positive behavioural change through gamification that came with its community. Fittr’s success is also largely attributed to the quality supply of trainers at affordable price points.

Similarly, Breathe, a diabetes reversal platform, believes it creates a flywheel: from starting off as a patient to becoming an athlete (day 30-60) to becoming a champion (day 120-180), inevitably leading to coaching new patients. Thereby, Breathe is solving for adherence while remaining hardware agnostic. While their TG includes individuals with high pain points in an annual income bracket of $5,000 - $8,000, their early traction implies that consumer mindsets are shifting towards greater adherence triggered by

For the community and gamification model, we strongly believe in the merits, however customer acquisition at scale is costly and LTV may not necessarily justify these costs. In principle, the model is well oiled but the Indian consumer’s stickiness remains in question, especially when hardware isn’t central to the business model.

Just as some diabetes upstarts target community, Sugar.fit and Fitterfly are focused on real time data and actionable insights as their hook. Identifying that self-monitoring blood glucose devices (SMBG) are primitive with respect to technology upgradations and that CGM devices by themselves cannot provide actionable insights, Sugar.fit believes real time data coupled with personalised nudges is the solution to controlling and reversing Type 2 diabetes.

.png)

.png)

Sugar.fit dashboard

As seen from the Sugar.fit dashboard above, the data captured enables an entire ecosystem comprising endocrinologists, diabetes coaches and fellow users on the same platform. Paramount importance is attributed to educational content and lifestyle interventions, which is otherwise lacking in the understanding of diabetes in India.

Think of the device this way: it reminds you that a certain meal didn’t bode well for your glucose levels the previous day and displays how your glucose levels are trending real time. A regular CGM only indicates the arrow in which glucose levels are headed, without any actionable knowledge on nutrition.

Fitterfly, who also plays the data game, differentiates itself within the data vertical through its personalised glycaemic response (PGR) engine. It provides exhaustive data on how macro and micronutrients impact blood glucose levels through CGM inputs. The caveat is that the data is only provided to the patient after the fortnight and is not provided in real time.

While data is invaluable and undoubtedly improves the control of any chronic disease, limited access to information and restrictive affordability of a

Speaking of accessibility, BeatO has curated a unique onboarding strategy with a free-of-cost starter kit, consisting of an IoT enabled glucose meter (shown below). Their tangible and intuitive hook (starter kit) solves for accessibility, awareness, and affordability.

USB connected glucometer

Affordability and accessibility are important parameters to consider when targeting the value conscious Indian consumer:

A key takeaway from deep diving into BeatO was the desire to penetrate a market, which has a large population with limited propensity to consume. To put this into context, 50%+ of India’s $17BN market is created by only 10% (annual income > ~$10,000) of the relevant population.

The final hook we identified in the direct to patient model was software. The likes of Wellthy and Phable have taken this route where either the majority of their sales come through doctors and enterprises, or the patients they eventually sell to are acquired through doctor partnerships. At least in the early phases of widening the market and increasing diabetes management adoption, we believe, the prospect of selling to diabetic customers will yield greater adherence and better growth numbers. As far as B2B goes, sales are a function of how well the doctor/hospital can draw in patients. In this scenario, growth is slightly passive.

Preventive over curative

As much as this disease requires companies building for better management solutions and reversal at scale, the hurdle for growth lies in the lack of financial incentives for customers. Without value based or outcome-oriented insurance, the direct to patient model tends to disincentivise diabetic patients to spend out-of-pocket, as oftentimes health costs are associated with an insurance provider. Therefore, the more universal approach to metabolic health by creating a “want to have” product rather than a “need to have product” creates eyeballs, aspiration, and a desire to own that product. Let’s face it, nobody likes to be targeted for their chronic condition. In a country like India, where health insurance is extremely under-penetrated, we believe offering predictive and proactive health devices sell better than reactive devices. For example, a device that gives you an inclination towards whether you might be pre-diabetic is far more enticing than a management solution (out-of-pocket expenditure) that helps monitor your diabetes.

Let me explain what I’m talking about. If I were to sell you a CGM sensor that uses glucose as a biomarker for metabolic health and gamifies those insights into a metabolic score, you would probably be interested. If the mobile application (which also senses your glucose levels) were to give you nudges based on what you should and shouldn’t eat and it told you what sleep times optimised for your metabolic score, you would probably be even more interested. If the same product were to give you content around fitness regimes, sleep management,

The core of Ultrahuman’s product is an Abbot Freestyle Libre Sensor, which is ditto to the core of Sugar.fit and Fitterfly’s product, as seen above. The difference lies in the interpretation of data, which is dependent on the categorisation of GTM. In the case of Ultrahuman, innumerable users with varying incentives can derive utility from the product, whereas the TG for diabetes focused players is restricted to diabetics. Here’s what the Ultrahuman product and ecosystem looks like.

.png)

When you understand a sandwich may not necessarily be the healthiest option for lunch because you witness a lower metabolic score, or you learn that fuelling yourself before a workout improves performance, or that red wine eventually leads to hypoglycaemia (low glucose levels), you are incentivised to further explore the product and recommend it to your network. Simply put, an accessible, consumable, and desirable product is more valuable than a product catered towards one type of individual, where the product is need-

As a final thought, India is at the tip of the iceberg when it comes to better diabetes management. However, for the iceberg to flip over, a few outcomes would have to occur. India would require widescale education on the repercussions of chronic disease mismanagement, coupled with genuine full stack players providing accessibility and affordability. As India’s insurance penetration increases and diabetes medication and management solutions start getting covered, India’s diabetes TAM will increase sizeably. For the time being, the approach we find more comfort in is direct to consumer > direct to patient. Not only does the addressable market have more propensity to spend, but products are also 10x more aspirational. Finally, for clear winners to be determined in the Indian diabetes landscape, there will have to be widespread behavioural changes that are brought about by valuing longevity.

If you’re building something in the diabetes management space, or you agree/disagree with these views, or you just want to chat about healthcare, please reach out to siddhant@lightbox.vc