Will the Indian markets continue its love affair with the US markets? Are we ready to roll or are we riding the 2nd covid wave. How are the Indian markets still soaring admist the devastation caused by the 2nd wave? Find out!

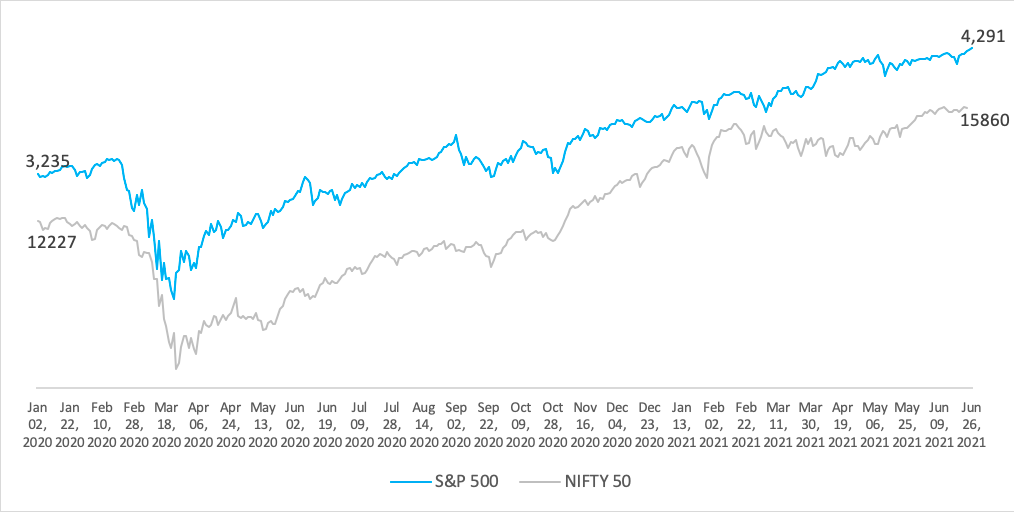

2020 was off to a promising start. The NIFTY 50, a benchmark Indian stock market index of the 50 largest Indian companies, closed trading at 12,182. On 16th Jan’20, the NIFTY 50, had closed out at a record high of 12,355, highest in the last 1 year. As news of the then novel coronavirus was hitting worldwide, it was not top of mind for India. So, when COVID-19 cases began to rise to a 100/day levels, India was in for a rude shock. During the 2nd week of Mar’20, the NIFTY 50 fell to the 10K levels before plunging to a record low of 7,610 on 24 Mar-20. To understand the India FY21 story, it’s crucial to look at the US markets.

Why? The Indian stock market has had a long-lasting romance with the US market. Changes in fed rate, US elections, dollar-rupee exchange rate, inflation rate, US-China relations all have had a deep and direct impact on the Indian markets. Dips and rises in the Indian public markets have often mirrored the US.

In 2020 too, after the S&P 500 crashed in March following the coronavirus and death toll in the US, the NIFTY 50 too rallied. The V-shaped recovery in both the markets were also similar. On deeper examination, the factors driving the US recovery in FY21 were different from India’s. We’ll be back to the India story in a bit.

Let’s try stepping into the US’s shoes 1 year ago…

It would never be the same for the United States after March 2020. Who would have thought?

The coronavirus was initially treated with trepidation and disregard based on which political side you were on. But, in just a month with over 150,000 confirmed cases, the US declared a national emergency in April 2020. In the 1st quarter of FY21, the US economic activity had plunged and the GDP had contracted by 4.8%. This was perhaps the biggest downturn since the 2008 financial crisis. By May 2020, 1.12MM cumulative cases of the coronavirus were recorded with a death rate of 6.1%.

On 4 May 2020, at a Berkshire Hathaway shareholder meeting, Warren Buffet said, “I remain convinced…nothing can basically stop America. The American miracle, the American magic has always prevailed and it will do so again.” While some felt he had erred on the side of over-optimism, turns out it was foolish to bet against Buffet.

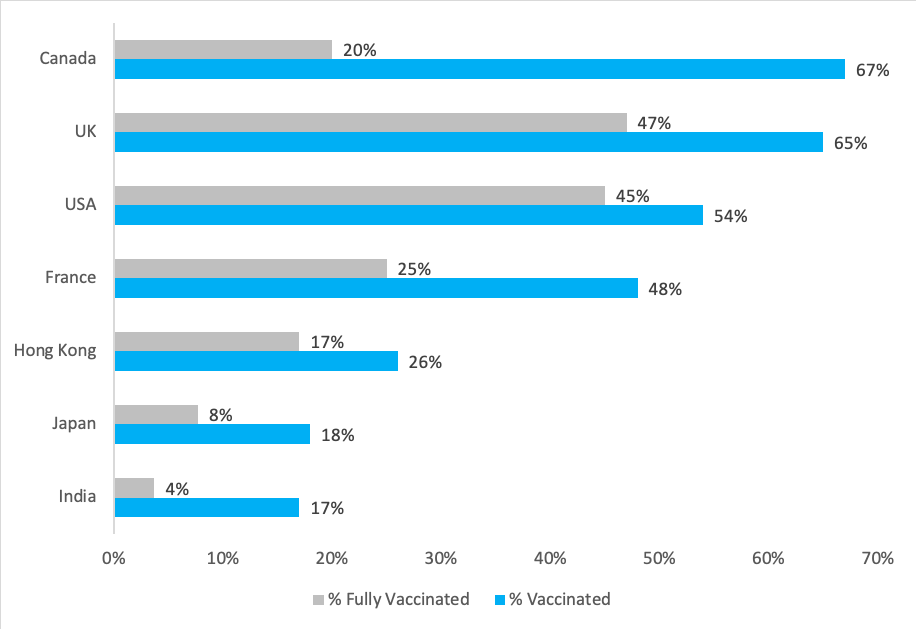

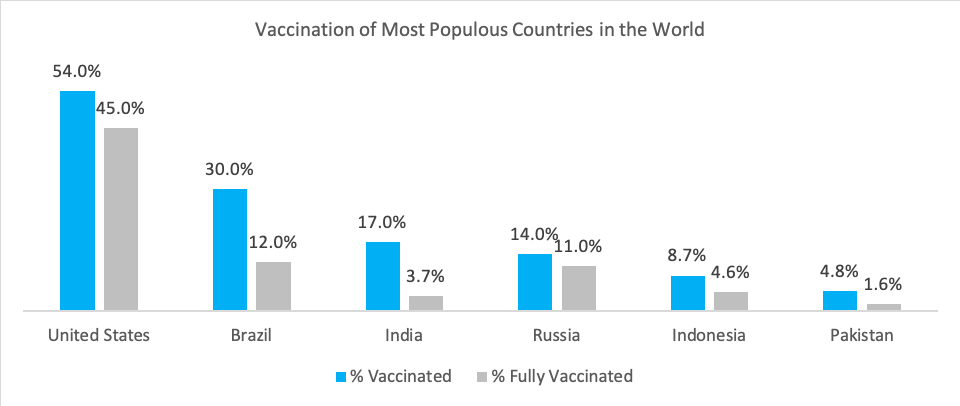

Exactly a year later, it was a great start for America. President Biden pledged to vaccinate 100 million people in 100 days on being elected. Ambitious? Yes. But it wasn’t a stretch by any means. The country hit the goal with 7 days to spare according to the NBC News analysis of Centre for Disease Control and Prevention. Today, 45% of the country have been fully inoculated.

Let’s compare this to the rest of the world. The world’s top economies are lagging behind the US. The UK has fully vaccinated 47% of its population and 65% of the population has been partially vaccinated. A large part of the US recovery can be attributed to the CARES Act law passed in Mar 2020 (by the Trump administration) which made no-strings-attached direct cash transfers to the vast majority of Americans for the 1st time. In December 2020 again, another bill offered additional unemployment benefits and a $600 one time/ person cash transfer under Biden. A total of $6Tn COVID relief stimulus injected in the economy dramatically increased unemployment benefits and left several workers financially better off than what they would have earned from their employers.

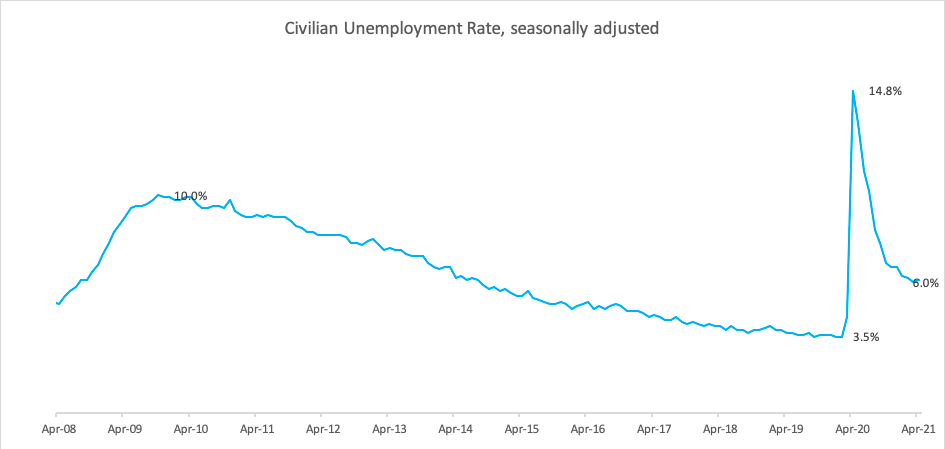

This trend is reflecting in the falling unemployment rates in the US today. Just to set context, at the peak of the 2008 financial crisis, unemployment rates in the US had risen to a whopping 10%. Just when we had written it off as a one-off, the number peaked to a 14.8% in April 2020 at the peak of COVID. This number has dramatically fallen to a 6% in April 2021.

While this number is a far outcry from the 3.5% pre-pandemic level unemployment, the number of people who filed for state unemployment benefits fell to 473,000 in May 2021, down 93% from April 2020 when 6.6MM people had filed for unemployment claims. But continued support of fiscal checks and consistent federal interest rate at 0.25% levels have not only supported growth but also propelled unemployment.

It’s therefore not surprising that the public markets echoed this economic buoyancy. The S&P 500, a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States, set new heights and soared and rose for the last 3 consecutive weeks at 4,247 (As on 12th June 2021). Stocks drifted higher while volatility fell as consumer sentiment rose in the US.

So, what are the underlying factors driving the American markets?

Consumerism made a comeback

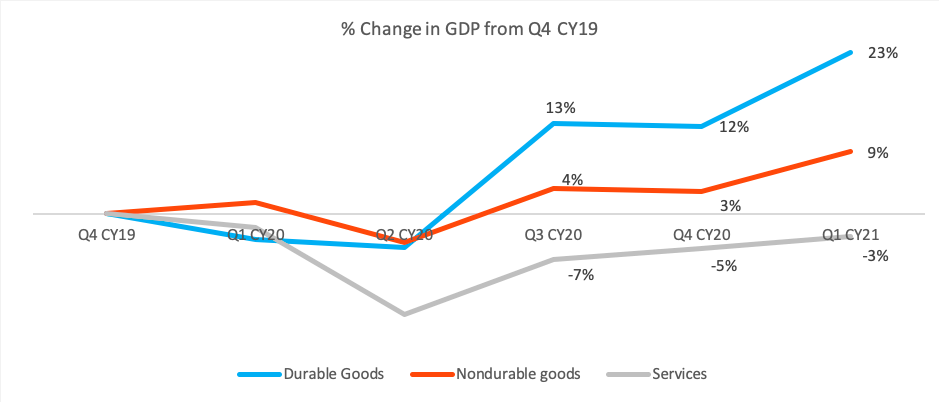

The huge impact on the public markets was fueled by higher spending, specifically by higher spending on things in the 1st quarter of 2021. Thanks to the COVID stimulus, American households were collectively sitting on $4.1TN savings, up from $1.2TN before the pandemic. With restaurants, movies and amusement parks remained shut for most part of 2020, Americans channeled their savings on goods.

They ramped up spends on automobiles, home utilities, real estate, retail as well as on clothes and food. While services have recovered more slowly as compared to the goods, as many as 16 out of 50 states in the US have now opened restaurants with absolutely no restrictions. According to an online research conducted by the New York Times and Survey Monkey, about 35% of Americans planned to spend on travel over the next 12 months than they do typically in a year and about 28% planned to spend more on restaurants than they normally do. Furthermore, with the recent ‘masks off’ for fully inoculated people, we can expect the services sector to make a complete recovery in the coming months.

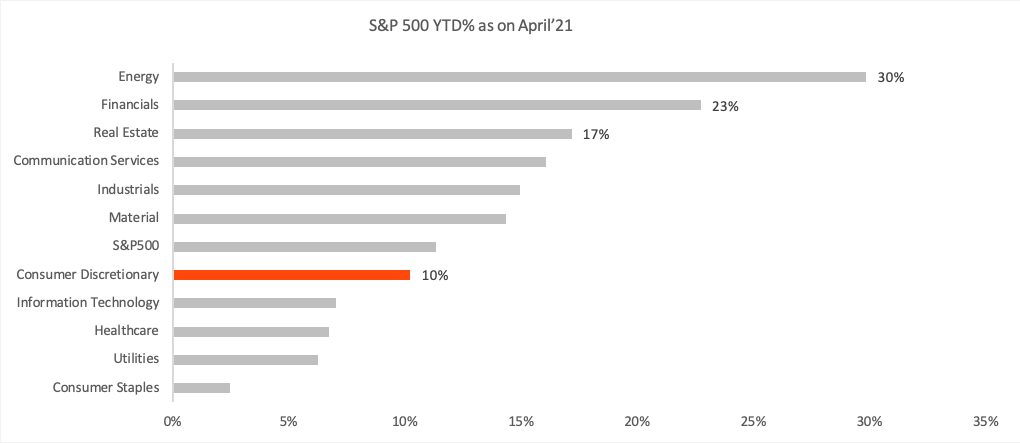

Energy, Financials, Real Estate grew the fastest in Q4 FY21

For the month, all 11 sectors gained on the S&P 500. Earnings easily beat expectations thanks to the COVID relief package and consumer spends. The most noteworthy was the energy sector that grew 29.87% YTD a stark contrast from December 20 when energy de-grew 37.31% for the year. A large driver of energy has been the world crude oil prices that crossed the $70 per barrel mark, the highest since June’19. Industry and manufacturing recovery has been another factor propelling the energy sector in the US. Not surprisingly, 11 out of the top 50 S&P 500 companies were oil and gas.

Real estate has also seen a major comeback from 2020 when it posted -5.17% loss on a 1 year basis. In April’21, it was up 17.18% YTD with a view of the US going back to work at the office. Mortgage interest rates have also been at a record low. So, many wealthy home buyers are seeking out their 2nd or 3rd homes, not in urban areas but in suburban neighborhoods. These homes are not necessarily a vacation home for a weekend getaway. The pandemic has changed priorities with regards to ownership of private property and space with increasing migration from densely populated urban areas.

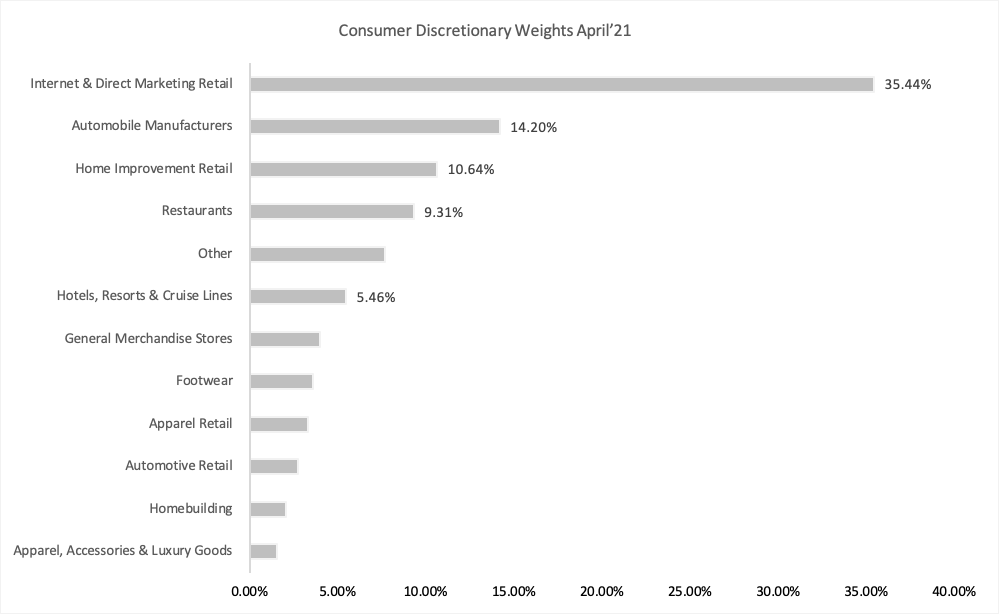

Similarly, the consumer stock receives mixed sentiment. Consumer discretionary was up 10.24% YTD while consumer staples saw a muted YTD growth of 2.49%. Consumer staples consistently saw a MoM growth in 2020 since the main focus was on essentials. But in the 1st quarter of 2021, US retail sales has increased 7.8% YoY. The pandemic induced shift to e-commerce (35.44%) accelerated this long-term trend. The auto sector (14.2%) since ownership of vehicles has increasingly become important to the consumer. 3.9MM cars were sold in the 1st quarter of 2021 alone, up 10% YoY. EVs saw a disproportionate growth, up 60% YoY, now accounting for 8% of total cars in the US.

As the US economy rebounded strongly on the back of increasing consumer spends, accelerated vaccination rates and higher employment, the India story played out a little differently.

Now, back to India.

While the Indian markets mirrored America’s 2020 V shaped recovery, the Indian economy remains jittery. The 2nd wave has proved to be more infectious and deadlier. Heartbreaking stories of loss of human life have poured in. The bottomline? The virus had wreaked havoc when India had let its guard down. In a sharp contrast with the US, India witnessed an exponential rise in the daily number of new cases of almost 400,000 at its peak in April with an even more devastating death count exceeding 300,000 as of 1 June-21.

While the US has fully vaccinated 45% of the country, India with a population of almost 4X of the US is trailing at a meagre 3.7% (As on 25 June-21). Even compared to the world’s most populous countries, India has some ground to cover.

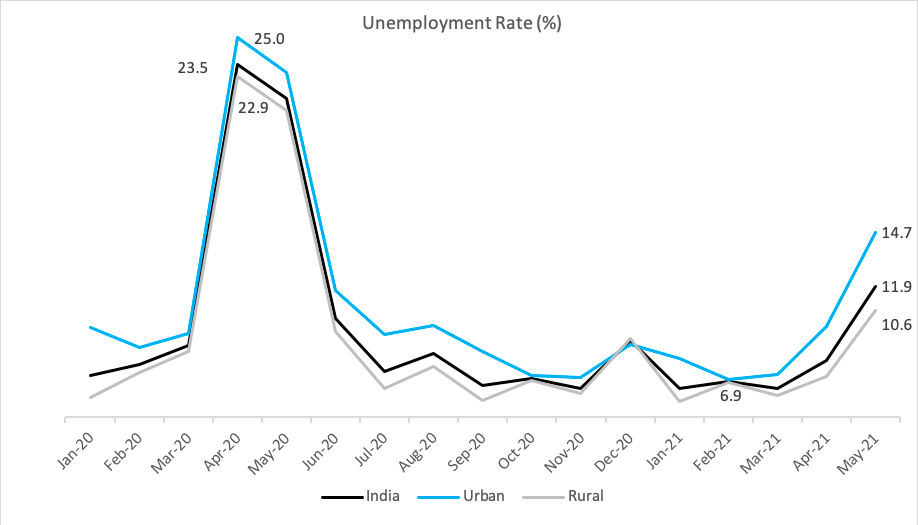

Brazil and Russia have each fully vaccinated 12% and 11% of their population respectively. While the 1st wave stressed both the demand and supply side, the 2nd wave has severely impacted aggregate consumer demand. Unemployment rates in India took an upturn in May at 11.9%. While India’s unemployment rate in April-20 was at 23.5%, the highest in the last 3 decades, it was substantially higher than the 6.9% in Feb-21, just before the 2nd wave.

The unemployment has been clearly higher in the urban areas as compared to the rural in the last 12 months. A clear driver has been that rural India is an agriculture driven economy and agriculture was the only sector that grew 3.6% in FY21. All other sectors de-grew- manufacturing (-7.2%), mining (-8.5%), construction (-8.6%) and broadcasting and trade, hotels and transportation (-18.2%). Another critical sign of a weakening economy has been the number of people opting for the MGNREGA (Mahatma Gandhi National Rural Employment Guarantee Act), increased to 40MM people in April-21 from 35MM in Mar-21. MGNREGA is a government run employment scheme that provides 100 days of employment at Rs. 182/day.

The deadly 2nd wave that not only spread faster and caught India at a time when it was on the recovery and had let its guard down. The heavy death toll and its impact on the recovery have made top agencies of the world alter their growth projections for FY22. Bloomberg slashed its earlier projection of 12.8% to 10.7%. Barclays also revised its growth estimates of 11% to 9.2%.

For the 2nd consecutive quarter now, the Indian capital market remains largely unaffected by the massive human crisis. NSE and BSE, both traded their highest in FY21. A transactional value of 2315Bn was traded in equity, up from 1360Bn in FY20. 743 Bn shares were traded on NSE alone compared to 467 Bn in FY20. NIFTY 50 continues to scale new heights at 15,799 (as on 12 June 21), up from 14,631 in April 21.

So, this really begs the question- How are Indian markets still soaring amidst a devastating 2nd wave and crumbling economic indicators? While consumer demand fueled the US public markets, the M3 money supply, lower trade deficit and continued contribution of retail investors boosted the public markets.

Money, money, money: Not exactly a rich man’s world

Money supply or M3 is a broad monetary aggregate of physical currency, deposits in banks, money in all accounts circulating in the economy. So, how does this really work? The total money in the economy in Q4 FY21 was $2.6Tn, the highest every! (up 4% QoQ). This basically translates to increase in liquidity in the economy. This was owing to :

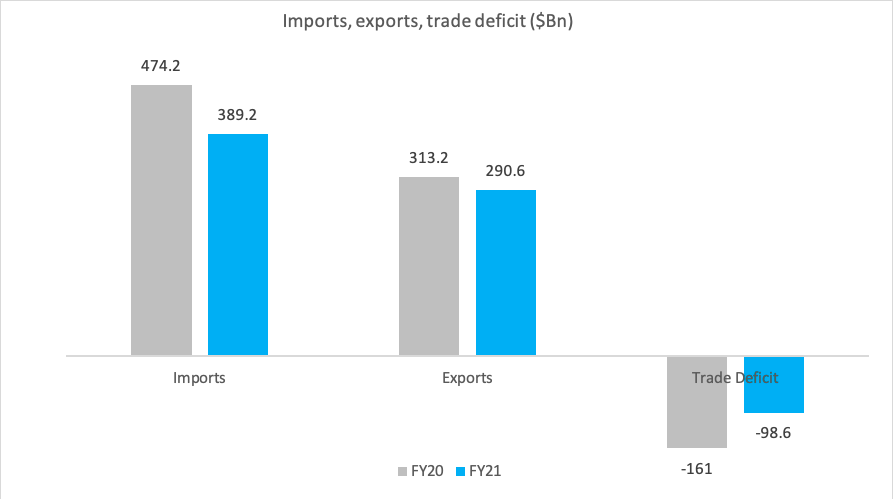

a. Trade deficits fell. By ALOT!

More exports and less imports? This would be great news in the ideal world. But since the times are anything but ideal, it’s safe to say that the trade deficit didn’t fall for the right reasons.

Source: CMIE

India’s merchandise Imports simply fell by a greater margin as compared to the merchandise exported. Crude oil constitutes about 21.2% of total imports and in FY21, imports for petroleum and crude oil fell by -36.9%. This sharp decline can be directly linked to the industrial production in India (IIP) where oil is an important commodity. To put this in perspective, in April-21, India’s industrial production was the same as it was in Apr-19 i.e. it de-grew by leaps and bounds in the last 12 months.

b. Global investors still love us/ India still is a long-term bet for global investors.

FDIs and FPIs in India were at an all-time high in FY21. A record $37Bn FPIs poured into India. India has been one of the biggest recipients driven by global liquidity, hopes of a faster recovery and strong fundamentals. In spite, of the 2nd wave, India still remains a strong long-term bet. The financial sector attracted the most FPI. FDIs equity inflow too was at an all time high of $81,72Bn.Computed software and hardware, IT accounted for 44% of total FDI followed by construction and services sector.

Millennials continued to drive the markets:

A few years back, Simon Sinek’s viral video accused millennials of being narcissistic, self-interested, unfocused, lazy,” and, most of all, “entitled”. He condescendingly said that it was ‘not their fault’ and blamed modern parenting styles. The irony today is that Indian millennial now contribute the most in the stock markets by both volume and value. Understanding and deal with money could be considered as one of the biggest signs of ‘Being responsible’. Take that, Sinek!

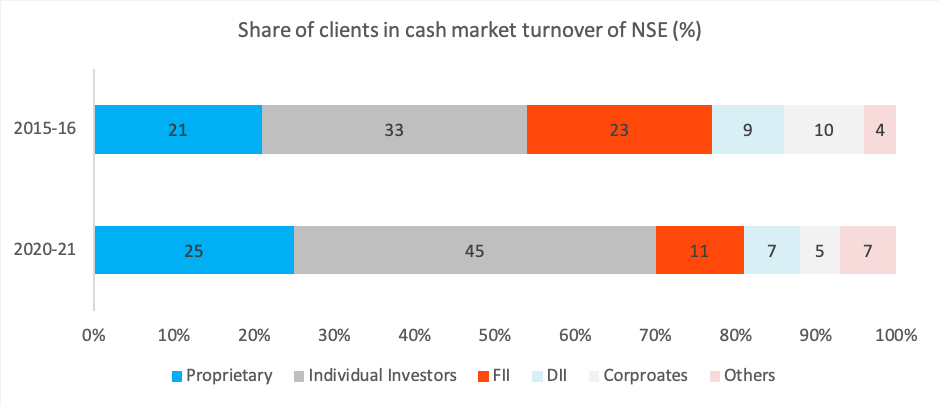

This trend was bolstered by the emergence of wealth-tech firms in India like Zerodha that democratized online trading by offering low brokerage charges and easy to understand interfaces that enabled an entire generation of young Indians to make their money work for them. The number of new retail investors in FY21 was 1.3X of FY20 and today, retail investors contribute 45% to the total cash market turnover on NSE, surpassing proprietary firms, mutual funds, financial institutions and corporates.

Last but not the least, plateauing new corona cases (from 400,000 to <100,000) coupled with the latest announcement of INR 6.28 lakh crore stimulus post 2nd COVID wave by Finance Minister Nirmala Sitharaman focusing on credit guarantees for stressed sectors like tourism, recent government nod for Cipla to import Moderna’s COVID-19 drug, doubling of average daily doses administered in India to 4MM in Jun-21 have further created optimism that continue to reflect in the public markets. So, in FY22, the RBI sees reason to be ‘cautiously optimistic’ as the 2nd wave of the coronavirus has deeply impacted customer demand but the supply side surged amidst COVID protocols. While vaccination coverage and speed and investment in healthcare, research and logistics will be a key driver in shaping recovery, pressure points on demand will continue playing out in the next quarters.